Why Some Experts Say the Fed Needs a New Strategy—And What It Could Mean for Homebuyers

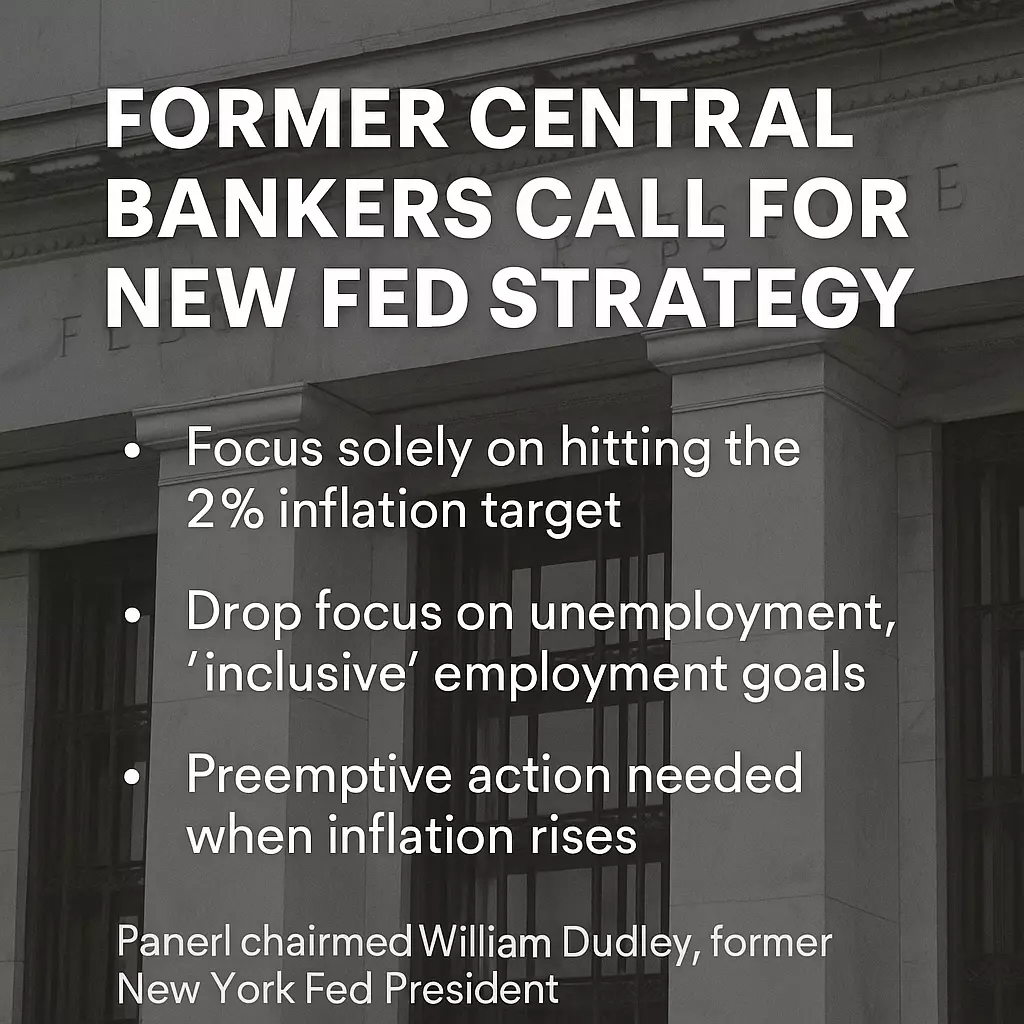

Should the Fed Change Its Game Plan? A Global Group of Former Central Bankers Thinks So.

As the Federal Reserve continues its strategic policy review in 2025, a high-powered international group of former central bank officials has a bold message: it’s time to ditch the current policy framework and refocus squarely on inflation.

The group—chaired by former New York Fed President William Dudley and composed of former central bankers from England, Japan, Mexico, Israel, and China—says the Fed’s 2020-era strategy may have unintentionally made inflation worse coming out of the pandemic. And their solution? Get back to basics. Target inflation first, and let job growth follow naturally.

Let’s break down what this means—and how it could impact you here in San Antonio.

🔍 What Is the Current Policy—and Why Is It Under Fire?

In 2020, the Fed adopted a framework designed to prioritize an inclusive recovery, especially after COVID-19 lockdowns. It pledged to tolerate periods of high inflation to make up for years of low inflation and committed to reaching "maximum employment" in a broader, more equitable way.

But critics—including this group of former top central bankers—argue that this policy slowed the Fed's reaction as inflation soared in 2021 and 2022. In their words, the Fed was “fighting the last war”—responding to an outdated problem while a new one was already here.

Their conclusion? Trying to control both inflation and employment equally is unrealistic. The Fed's tools—mainly interest rates and bond purchases—are much more effective at targeting inflation than they are at achieving social employment goals.

🏠 What Does This Mean for the Housing Market?

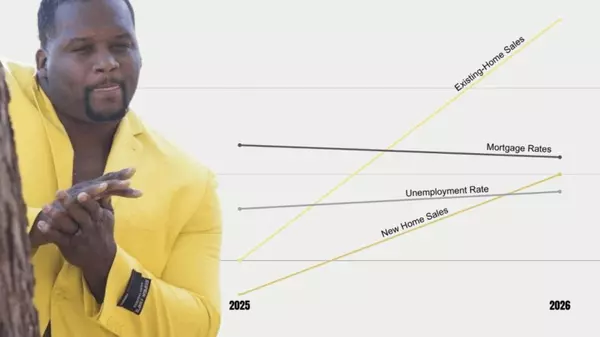

If the Fed shifts its focus back to strict inflation control, we could see a more proactive approach to raising or lowering interest rates, depending on where inflation goes next.

Here in San Antonio, we’re already seeing the impact of these national policies in real-time:

- Mortgage rates remain elevated (hovering between 6.8–7.1%), pricing some buyers out of the market.

- San Antonio has a 5.1-month housing inventory, offering more options than we've seen in years.

- New construction homes are leading the market with the largest inventory and an average price of $345,000—often coupled with incentives like rate buydowns and closing cost assistance.

- Existing homeowners, many of whom refinanced at 3% rates, are holding off on selling—further limiting resale inventory.

If the Fed adopts a stricter anti-inflation stance, it could delay future rate cuts, keeping borrowing costs high a bit longer. On the flip side, it might also bring more predictability to the economy—something buyers and sellers desperately need right now.

📉 What the G30 Recommends Instead

The report by the Group of Thirty (G30) includes several proposals for the Fed:

- Drop the focus on “inclusive” employment metrics. Acknowledge that monetary policy is not the right tool for addressing inequality.

- Recommit to the 2% inflation target—without “make-up” policies.

- Revamp how interest rates are managed.

- Give clearer guidance on when and how bond-buying (quantitative easing) will be used.

- Improve forecasting to regain public trust and reduce economic uncertainty.

💬 What Does This Mean for You?

If you're a homebuyer, homeowner, or investor, here’s what to watch:

- Stability over surprise. A clearer Fed policy could stabilize mortgage rates and improve buyer confidence.

- Affordability still matters. Even if inflation cools, home affordability will continue to hinge on wage growth, loan programs, and local market conditions.

- Now is still a strategic time to buy—especially in San Antonio. Incentives from builders and motivated sellers can help offset higher borrowing costs.

🔑 Final Thoughts

The debate over how the Federal Reserve should set policy isn’t just for economists—it affects everything from your mortgage rate to your monthly grocery bill. As the Fed reconsiders its approach, the hope is for a framework that brings more balance, clarity, and long-term stability to the economy.

If you’re navigating this market and wondering what it means for your next move, reach out today. I can help you interpret the data, understand your options, and find the best opportunities in San Antonio’s evolving real estate market.

Categories

Recent Posts

"Molly's job is to find and attract mastery-based agents to the office, protect the culture, and make sure everyone is happy! "