Why Housing Affordability — Not Shortage — Is San Antonio’s Real Challenge

Spoiler alert: Housing affordability isn’t as simple as the headlines make it sound.

Depending on who you ask, the real issue isn’t just the price of homes or even the number of listings on the market. It’s about access. It’s about opportunity. And most importantly, it’s about what affordable really means for the people trying to buy.

So what does affordability look like right now in Texas — and especially in San Antonio? Where do buyers actually stand a chance of finding the right home at the right price?

Let’s break it down.

Inventory Crisis or Access Crisis?

If you've been following the national conversation, you've probably heard a lot about the "housing shortage." But two of the most respected voices in real estate data — Ivy Zelman and Logan Mohtashami — offer different insights into what’s really going on.

Ivy Zelman’s Take: It’s an Access Problem

If you haven’t heard of Ivy Zelman, she’s famous for predicting the 2008 housing market collapse three years before it happened. Today, she points out that the real problem isn’t just a lack of homes — it’s a lack of affordable homes.

As she explains:

“You could talk as much as you want about how many units might be short, but if you can’t offer a rental unit at less than a thousand a month or a mortgage payment at a thousand dollars a month, who really cares?”

In other words: it doesn’t matter how many homes are out there if typical buyers can’t afford them.

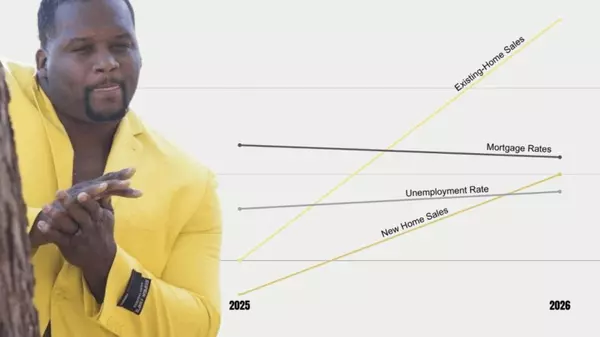

Logan Mohtashami’s Take: Affordability Has Always Been a Challenge

Meanwhile, housing analyst Logan Mohtashami asks an important question:

“When was housing ever affordable?”

Home prices have historically risen during almost every major inflationary period — from the 1940s, to the 1970s, to the pandemic boom. Waiting for a massive price crash? That’s not a strategy — that’s wishful thinking.

Instead, buyers have traditionally made homeownership work by:

- Combining incomes

- Being flexible about location

- Adjusting expectations about size or features

How Does Texas Compare?

While national experts debate the “why,” Realtor.com’s State Report Cards offer a data-driven look at housing conditions:

- REALTORS® Affordability Score: 25% weight

- Median earner’s share of income spent on housing: 25% weight

- Permit-to-population ratio: 40% weight

- New construction premium (lower is better): 10% weight

✅ Texas earned an A- grade, with a median list price of $370,663 — well below the national average.

✅ Texas ranks #3 nationally for new construction activity, helping moderate price pressure compared to many other states.

✅ Southern and Midwestern states generally fared better, while the West and Northeast continue to struggle with affordability.

San Antonio: The Local Reality

Now, let's zoom in to San Antonio — because what matters most is what's happening right here.

San Antonio Housing Market Snapshot (April 2025):

- Inventory Levels: 5.1 months (highest inventory in years)

- Median Sold Price (pre-owned homes): $299,000

- Median Price for New Builds: $345,000

- Seller Concessions: Average around $8,400, giving buyers room to negotiate

- Average Days on Market: About 80 days — buyers have more breathing room compared to previous years

👉 New construction is leading the way right now. Builders are offering:

- Lower prices than resale homes

- Rate buydown incentives

- Closing cost assistance

- Move-in-ready homes with upgraded features

In fact, new build incentives are making it easier for buyers to bridge the affordability gap without sacrificing their must-haves.

So, What Does This Mean for You?

The good news? There are still many paths forward to owning a home in San Antonio — even with today's challenges.

Here’s how smart buyers are winning in today’s market:

- Getting pre-approved early to define a realistic budget

- Exploring alternative loan programs, like adjustable-rate mortgages, first-time buyer grants, and temporary buydowns

- Considering new construction for the best deals

- Being flexible about location, size, or features

- Using down payment assistance and other local programs that help bridge the gap

Final Thoughts: Access, Not Panic

Yes, prices have risen. Yes, interest rates are still higher than historic lows. But housing affordability is evolving — not disappearing.

If you’re serious about buying a home in San Antonio, you need the right strategy, the right financing, and the right local guidance.

📩 Contact me today to explore the latest opportunities in our market — before competition heats up again.

Categories

Recent Posts

"Molly's job is to find and attract mastery-based agents to the office, protect the culture, and make sure everyone is happy! "