Why It’s Time to Rethink Interest Rates—for the Good of Homebuyers Everywhere

You may have seen headlines buzzing about President Donald Trump urging Federal Reserve Chairman Jerome Powell to start cutting interest rates. While political commentary usually stirs up debate, we’re putting the politics aside—because there’s a bigger conversation that every homebuyer should care about.

The real question is: Are current interest rate policies still helping—or are they holding people back from achieving homeownership?

Let’s break it down in a way that matters to you, especially if you’re thinking about buying a home in San Antonio (or anywhere in Texas).

What’s the Deal With the 2% Inflation Target?

For years, the Federal Reserve has used a 2% inflation target to determine when and how to adjust interest rates. In theory, keeping inflation around 2% helps protect your buying power without triggering runaway prices.

But here’s something you may not know: That 2% number wasn’t even invented in the U.S. It originated in New Zealand in the 1990s and was adopted by global economists later on. It was officially embraced by the Fed in 2012, during a completely different economic era.

Today’s economy looks nothing like the one that shaped the 2% rule:

- Population growth is slower.

- Supply chains are more fragile.

- Wages and productivity aren’t growing at the same pace.

Still, we’re using the same old playbook.

Why This Matters for Homebuyers

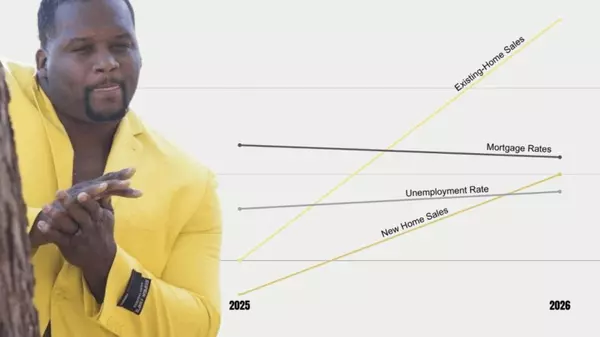

When the Fed targets 2% inflation, it often keeps interest rates higher to slow down the economy—even when those high rates are no longer necessary. That’s why mortgage rates have stayed between 6.5% and 7% lately, even though inflation is cooling off.

If you’re a first-time buyer or a growing family in San Antonio, those higher rates can price you out of the market—or significantly raise your monthly payments.

Here’s the irony: In 2024, home values in Bexar County actually dropped by 1.2% to 2.1%, but buyers are still dealing with elevated mortgage rates. Lower prices + high interest = a lose-lose for homebuyers.

Why a New Approach to Inflation Could Help

Many economists now argue that raising the inflation target to 2.5% or even 3% could benefit the entire economy. Here’s why:

- It allows lower interest rates, which makes mortgages more affordable.

- It encourages spending and investment, which drives economic growth.

- It helps manage debt, including student loans and credit card balances.

And rather than using a one-size-fits-all target, some experts believe we should adopt regional and sector-based inflation benchmarks. That could mean different strategies for booming tech hubs versus rural towns, allowing markets like San Antonio to grow more organically.

What Homebuyers Can Hope For

If the Federal Reserve adjusted its policies and allowed for slightly higher inflation, mortgage rates could come down faster. That would mean:

- Lower monthly payments

- Better affordability

- More buying power for everyday families

It’s not about “free money” or risky lending—it’s about recognizing that today’s economy isn’t yesterday’s economy.

Final Thoughts

As homebuyers navigate interest rates, appraisals, and ever-changing inventory, it’s clear that policy must evolve to meet reality.

Whether or not you agree with political voices calling for rate cuts, one thing is certain: it’s time to have a real conversation about interest rates and inflation targets that better serve homebuyers—not just economic theory.

Because when more families can afford to buy a home, everyone wins.

Thinking about buying in San Antonio? Let’s chat. I’ll walk you through your options based on today’s rates, local market trends, and what makes the most financial sense for your future.

Categories

Recent Posts

"Molly's job is to find and attract mastery-based agents to the office, protect the culture, and make sure everyone is happy! "