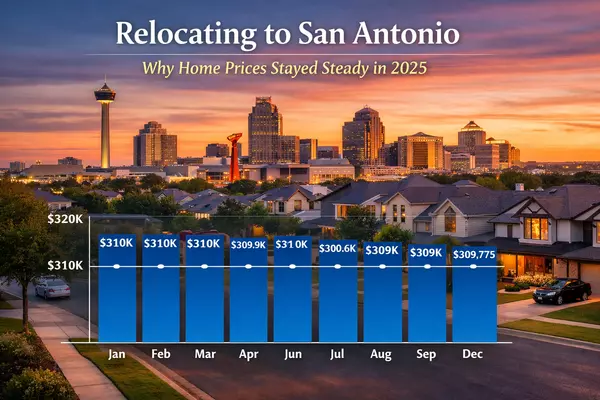

Trump Directs Fannie Mae and Freddie Mac to Buy $200B in Mortgage Bonds

What This Could Mean for Mortgage Rates and Refinancing Opportunities A major housing market headline is gaining attention after Donald J. Trump announced he is directing Fannie Mae and Freddie Mac to purchase $200B in mortgage backed securities. The goal is simple. Push mortgage rates lower and imp

Read More

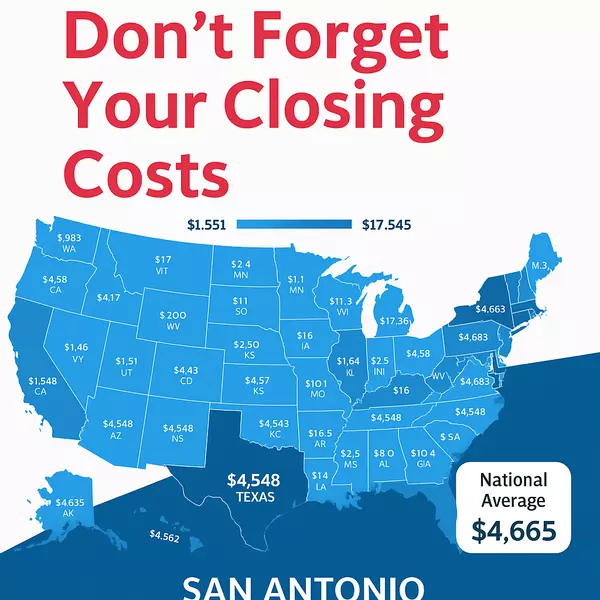

How to Save Thousands When Buying a Home in San Antonio

Buying a home in San Antonio is exciting, but it’s also one of the biggest financial decisions you’ll ever make. Whether you’re moving across the city or relocating from out of state, knowing how to make strategic choices can help you keep more money in your pocketwithout sacrificing the home you lo

Read More

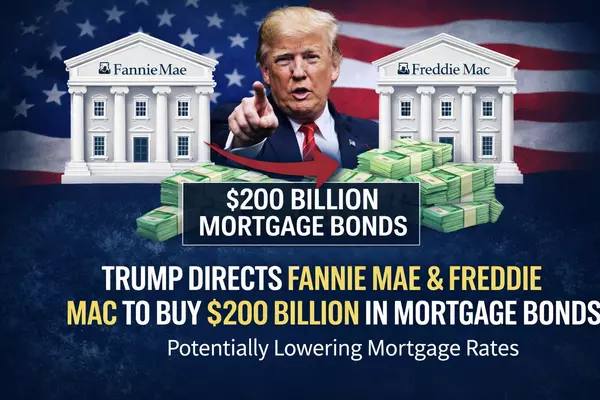

San Antonio Homebuyers: Don’t Forget Closing Costs When Saving for a Home

Saving to Buy a Home? Don’t Forget Your Closing Costs Most buyers save for their down payment, but many underestimate what closing costs will add to the bill. And these aren’t the same everywhere. In some states, closing costs average $2,000 to $3,000. In others, like Washington D.C., they can top $

Read More

Big News: New Credit Score Model Could Help More Buyers Qualify for a Mortgage in 2025

Could You Finally Qualify for a Mortgage in 2025? This New Credit Score Model Says Yes. If you’ve been told “you don’t qualify” for a mortgage due to your credit score, 2025 may finally be your year. Fannie Mae and Freddie Mac just dropped a major announcement that could open the doors to homeowners

Read More

Categories

Recent Posts