A ‘Property Tax Revolt’ Is Brewing — Here’s What’s Happening in San Antonio

Across the U.S., frustration with soaring property tax bills is reaching a boiling point. And San Antonio is no exception.

New data reveals why this issue is quickly becoming one of the hottest topics for homeowners, buyers, and policymakers — both nationwide and right here in Bexar County.

Let’s dive into what’s happening — and what it could mean for you.

Why Are Property Taxes in the Spotlight?

Property taxes are highly local, but across the country, they’ve been climbing fast:

- In 2024, the average property tax bill on a single-family home rose by 2.7% nationally.

- In 157 out of 217 metro areas studied, property tax increases were even higher than the national average.

- Homeowners are feeling the squeeze not just from rising home values, but from higher costs of running local governments, schools, and public services.

In 2024, the average property tax bill hit $4,172 nationally — with New Jersey leading the pack at $10,135 and West Virginia residents paying the least at around $1,027.

In Texas, where there’s no state income tax, property taxes carry even greater importance for funding essential services. As a result, Texans — especially in fast-growing areas like San Antonio — are seeing rising bills at a time when other living costs are also climbing.

San Antonio’s Property Tax Reality

Here’s a snapshot of the property tax situation closer to home:

- Bexar County has seen significant increases in assessed property values over the last few years, putting many homeowners at risk of higher tax bills.

- Median property tax bill in San Antonio (2024): approximately $4,081 — slightly under the national average, but up from $3,876 in 2023.

- Protests are rising: Bexar County Appraisal District (BCAD) reported more than 168,000 protests filed in 2024 — a historic high.

- Top reasons for protests include overinflated appraisals, inaccurate property condition reports, and major discrepancies compared to neighboring homes.

Even though San Antonio’s housing market offers relatively affordable prices compared to many other Texas cities, rising tax bills are putting additional pressure on homeowners who are also grappling with higher insurance premiums, utility costs, and maintenance expenses.

Why Are Property Taxes Rising?

According to property data firm Attom, there are several reasons behind the upward trend:

- Pandemic-related inflation drove up housing costs and local government expenses.

- Federal aid to cities and counties during the pandemic has ended — and municipalities must now rely more heavily on local tax bases.

- Work-from-home trends have reduced the value of commercial real estate in many downtown areas, shifting more of the tax burden to residential homeowners.

In San Antonio, population growth has further fueled demand for public services like schools, infrastructure, and emergency services — all of which are funded largely through property taxes.

A New “Property Tax Revolt” Is Brewing

Experts like Jared Walczak from the Tax Foundation say the public mood feels similar to the anti-tax sentiment of the 1970s, which led to landmark measures like California’s Proposition 13 (capping property tax increases).

Today, several states are grappling with how to respond:

- Florida is considering eliminating property taxes altogether.

- Iowa and Kansas are actively working to reform their property-tax systems.

- North Dakota voters recently rejected a proposal to abolish property taxes, instead demanding reforms.

In Texas, local governments are feeling the heat too. After massive property appraisal spikes in major cities — including San Antonio — lawmakers continue to discuss tighter limits on tax hikes and expanded protest rights for homeowners.

What San Antonio Homeowners Are Doing About It

More homeowners are fighting back through property tax protests:

- In Bexar County, more than 30% of residential properties were protested in 2024.

- Homeowners who successfully protested their appraised value saved an average of $473 on their annual tax bills, according to BCAD data.

Still, experts warn that many homeowners who could lower their bills never challenge their assessments.

Protesting your property taxes can be a powerful way to ensure you’re not paying more than your fair share — but you must be proactive. You’ll need evidence, such as comparable sales data, photos of property condition, or third-party appraisals to make a strong case.

What’s Next for San Antonio?

Even as tax protests surge, the underlying issues remain:

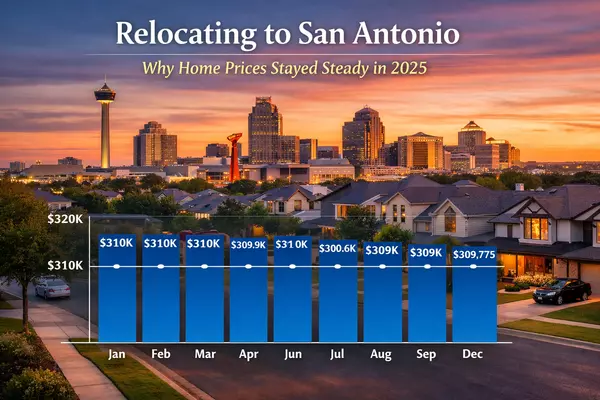

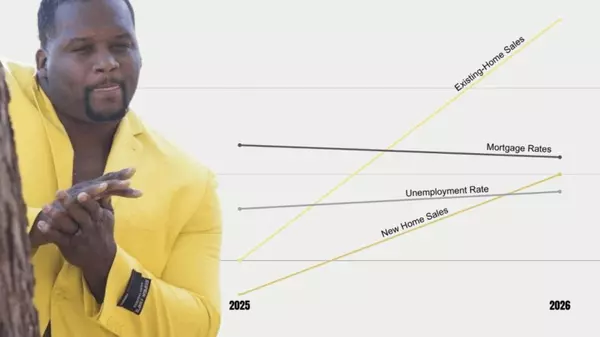

- San Antonio’s housing inventory is higher than in past years (5.1 months of supply as of April 2025).

- Median home prices are moderating: the median price for pre-owned homes is $299,000, while new construction homes average $345,000 — still lower than in Austin or Dallas.

- Massive growth across the San Antonio metro area (especially in suburbs like Cibolo, Schertz, and New Braunfels) will continue to drive demand — and local governments will need funding to keep up.

Ultimately, balancing housing affordability with funding community services will remain one of San Antonio’s biggest challenges in the years ahead.

Final Thoughts

If you’re a homeowner in San Antonio (or thinking about buying soon), it’s essential to:

- Review your property tax appraisal carefully each year.

- File a protest if you believe your valuation is too high.

- Stay informed about potential tax reforms and local elections that impact property tax rates.

- Budget wisely for property taxes as part of your total cost of homeownership.

Have questions about property tax protests or want advice on navigating the San Antonio housing market?

📩 Contact me today — let’s make sure you’re fully prepared for what’s ahead!

Categories

Recent Posts

"Molly's job is to find and attract mastery-based agents to the office, protect the culture, and make sure everyone is happy! "