Understanding the Texas Homestead Exemption: What Homeowners Need to Know in 2025

Texas is known for its wide-open spaces, strong property rights—and yes, its property taxes. But did you know there’s a powerful tool that can help reduce what you owe each year? It’s called the Texas Homestead Exemption, and it could save you thousands of dollars on your property tax bill.

If you’re a Texas homeowner—or planning to become one—this blog breaks down everything you need to know about homestead exemptions in 2025, including eligibility, how to apply, and new updates you don’t want to miss.

💡 What Is a Texas Homestead Exemption?

The Texas Homestead Exemption is a property tax benefit that lowers the taxable value of your primary residence, which in turn lowers your property tax bill. In basic terms: if your home is worth $300,000 and you qualify for the $100,000 school district exemption, you’ll pay school taxes on only $200,000.

Homestead exemptions can also:

- Shield your home from certain creditors (bankruptcy, death, etc.)

- Help lower taxes for seniors, disabled individuals, and veterans

- Be applied to homes up to 20 acres used for residential purposes

📅 Important Deadlines & Application Tips

- Application Deadline: Submit your application by April 30 to your county’s appraisal district.

- Where to Apply: File with the Bexar County Appraisal District (or your local county if outside San Antonio).

- Required Documents: Texas driver's license or ID must match your property address.

Good news: Once approved, the exemption typically stays in place without needing to reapply each year. That said, new in 2024, Texas implemented a 5-year renewal rule, meaning you’ll need to confirm your eligibility every five years.

📈 Types of Homestead Exemptions in Texas

✅ Standard Homestead Exemption

- $100,000 school district exemption (increased from $40,000 in 2023)

- Up to 20% optional local exemption from counties, cities, or special districts

👴 Age 65+ Exemption

- Additional $10,000 exemption

- May include a school tax freeze (your school taxes won’t increase)

♿ Disability Exemption

- Available to homeowners with qualifying disabilities

- May be combined with the 65+ exemption if from different taxing units

🎖️ Veteran & Surviving Spouse Exemptions

- Partial or total exemption depending on your VA disability rating

- Surviving spouses of veterans and first responders may qualify for full exemption if they remain unmarried

🏠 Who Qualifies?

To be eligible:

- The property must be your primary residence as of January 1

- You must own the home (even if jointly with a spouse)

- It must not be used as a vacation or rental home

- The address on your ID must match the homestead address

Even mobile homes and inherited property can qualify with proper documentation.

✍️ How to Apply for a Homestead Exemption in Bexar County

- Download the Residence Homestead Exemption Application

- Gather ID and supporting documents

- Submit the application before May 1 to:

📬

Bexar Appraisal District

411 N. Frio St.

San Antonio, TX 78207

Or apply online at www.bcad.org

🚨 What Happens If You Miss the Deadline?

You may still be able to apply:

- Up to 1 year after taxes become delinquent

- Up to 2 years late for seniors or disabled homeowners

- Up to 5 years late for disabled veterans

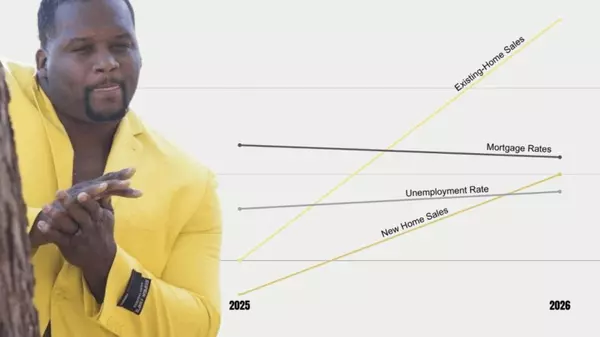

🆕 What’s New in 2025?

- Texas is considering increasing the homestead exemption from $100,000 to $140,000, and up to $150,000 for seniors, pending a vote in November 2025

- The new 5-year requalification rule means you must reconfirm your exemption eligibility every five years

- If you protest your 2025 appraisal and win, that value will roll over to 2026, saving you time and money next year

🧾 Final Thoughts: Save More With Your Homestead

The Texas Homestead Exemption is one of the most effective ways to reduce your property tax bill—and with recent changes, it's more valuable than ever. Whether you're a first-time homeowner, military family, senior citizen, or someone with a disability, there's likely a tax break with your name on it.

💬 Need Help?

If you’re in San Antonio or Bexar County, reach out today for help filing your exemption or protesting your valuation. As a local Realtor and advocate for Texas homeowners, I’m here to make the process easier and stress-free.

📌 Quick Links:

- Bexar Appraisal District Exemption Info

- Texas Homestead Exemption Form (PDF)

- Check Your 2025 Appraisal Notice

🏡 Kristen Smith, San Antonio’s Veteran Realtor

Helping homeowners save smarter and buy wiser.

Categories

Recent Posts

"Molly's job is to find and attract mastery-based agents to the office, protect the culture, and make sure everyone is happy! "