Will Mortgage Rates Drop in 2025? Here’s What Needs to Happen

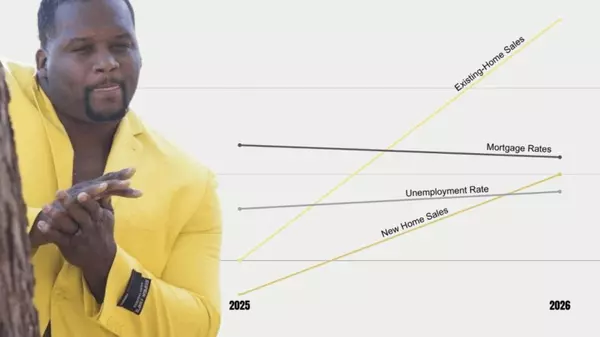

If you're waiting for mortgage rates to drop before buying a home, you may want to keep a close eye on the economic landscape in 2025. Right now, there are only three major factors that could significantly bring mortgage rates down:

- A Crisis-Like, Black Swan Event

- The Labor Market Breaks

- Inflation Returns to 2%

Let’s break down these possibilities and what they could mean for homebuyers and sellers in the coming year.

- A Crisis-Like, Black Swan Event

A black swan event is an unpredictable, high-impact occurrence—something like a financial crisis, geopolitical conflict, or an economic collapse. Historically, these kinds of events have led to lower interest rates as investors flock to safer assets like bonds, which in turn pushes mortgage rates down.

While no one hopes for such instability, it remains a factor that could shift the housing market in unexpected ways.

- The Labor Market Breaks

The U.S. labor market has remained relatively strong despite economic uncertainty. However, if unemployment spikes or wage growth slows significantly, the Federal Reserve could be forced to step in and adjust interest rates to stimulate economic activity.

If companies start laying off workers at a rapid pace and job openings dry up, mortgage rates could decline as a response to a cooling economy. However, this scenario would also mean a tougher financial situation for many households, which could reduce home-buying demand.

- Inflation Returns to 2%

The Federal Reserve has a long-term goal of bringing inflation back down to 2%. If inflation stabilizes at this level, it would allow the Fed to maintain lower interest rates, leading to a potential drop in mortgage rates.

However, recent Fed commentary suggests that even as they lower their policy rate (like they did with a 100 basis point cut), longer-term mortgage rates may not immediately follow suit.

What the Fed Says About Mortgage Rates

Federal Reserve Chair Jerome Powell recently addressed this issue, saying:

“As we've reduced our policy rate 100 basis points, longer rates have gone up—not principally because of expectations about our policy or about inflation. It's more a term premium story. And you know it's long rates that matter for housing, so I think these higher rates probably hold back housing activity to some extent if they're persistent; we'll have to see how long they persist.”

What does this mean? Essentially, the Fed has some control over short-term rates, but long-term mortgage rates are influenced by broader market conditions, including investor sentiment and global economic factors.

What This Means for Homebuyers and Sellers

If you're considering buying a home in 2025, don't solely rely on the hope that mortgage rates will drop significantly. While rates may fluctuate, they’re unlikely to return to the historically low levels seen in 2020 and 2021.

Here’s what you can do:

- If you’re a buyer: Focus on affordability rather than waiting for the "perfect" interest rate. Consider locking in a rate now and refinancing later if rates drop.

- If you’re a seller: Be realistic about pricing, as higher rates may continue to impact buyer demand.

The bottom line? Mortgage rates will move based on economic conditions, and while they may come down slightly, significant drops will require major shifts in inflation, employment, or global events.

Want to discuss how this impacts your real estate goals? Contact Kristen Smith, Realtor today!

Categories

Recent Posts

"Molly's job is to find and attract mastery-based agents to the office, protect the culture, and make sure everyone is happy! "