How to Save Thousands When Buying a Home in San Antonio

Buying a home in San Antonio is exciting, but it’s also one of the biggest financial decisions you’ll ever make. Whether you’re moving across the city or relocating from out of state, knowing how to make strategic choices can help you keep more money in your pocketwithout sacrificing the home you love.

If you want to buy in San Antonio without going over budget, here’s where the savings are hiding.

Your Choices Matter More Than the Market

Mortgage rates rise and fall with the economy, but your personal rate depends largely on you, your credit, your down payment, and even which lender you choose.

Realtor.com® found that when average rates hovered around 6.6%, borrowers with stronger financial profiles secured rates closer to 6.25%, while others paid closer to 7%. That half-point difference can add up fast. On a $425,000 home, that’s more than $60,000 saved over a 30-year loan.

You can’t control the market, but you can control what you pay.

The Biggest Savings Come from Comparing Lenders

Shopping around for a lender might be the easiest way to save thousands. Realtor.com’s analysis of nearly two million loans found that borrowers who compared multiple lenders saved an average of $44,000 over the life of their mortgage.

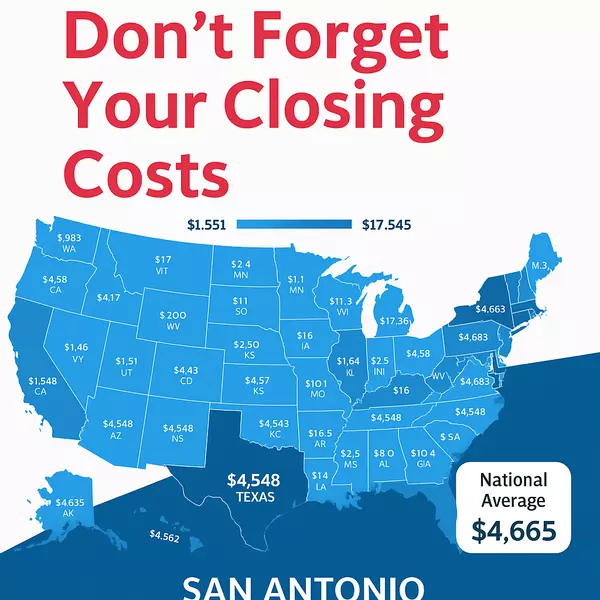

For a buyer in San Antonio purchasing a $425,000 home with 20% down, rate differences between lenders could mean:

- About $122 less per month

- Around $1,464 per year

- Nearly $44,000 saved over 30 years

Contact at least three lenders on the same day and ask each for a written quote. Don’t just compare interest rates look at fees, points, and total loan costs. Then ask your preferred lender if they can match or beat the best offer. A few extra calls could mean years of savings.

Credit and Down Payment Moves That Pay Off

You don’t need perfect credit to get a good rate, but every small improvement helps. Raising your score from “good” (660–720) to “very good” (720–760) could lower your rate by about 0.11 percentage points roughly $24 a month or more than $8,000 over the life of your loan.

Increasing your down payment can make an even bigger impact. Moving from 10% down to 20% can save you both mortgage insurance (PMI) and interest around $281 per month and over $100,000 in total savings on a $425,000 home.

If 20% down feels out of reach, don’t worry. Explore these programs designed to help:

- FHA Loans: As little as 3.5% down

- VA Loans: No down payment for eligible veterans

- USDA Loans: No down payment for qualifying rural properties

- Local & State Programs: Grants and low-interest loans for first-time buyers in Texas

Property Type and Use Can Change Your Rate

Your interest rate doesn’t just depend on you it depends on the property itself.

Second homes and investment properties often carry higher rates about half a percentage point more than primary residences. Condos, manufactured homes, and co-ops can also cost more to finance, while single-family homes and planned communities often qualify for lower rates.

If you’re considering multiple property types around San Antonio, talk with your lender early about how each might affect your rate and eligibility.

Smart Ways to Save Before and After You Buy

Once you’ve locked in a great rate, you can still lower your monthly costs with a few smart strategies:

- Shop your home insurance: Compare quotes every year to make sure you’re not overpaying.

- Bundle your policies: Combining home and auto insurance can save 10–20%.

- Boost energy efficiency: Upgrading insulation, windows, or appliances can cut energy costs by 10–30%.

- Review your property taxes: After closing, check your Bexar County assessment and protest if it seems too high.

- Set up auto-pay: Some lenders offer small discounts or fee waivers for automatic payments.

Each step may seem minor, but together they can free up hundreds each month and strengthen your long-term financial security.

The Power of a Strong Negotiator

A skilled buyer’s agent can save you money before you even close. In San Antonio’s competitive market, you want someone who understands local pricing, knows when a home is under or overpriced, and can negotiate in your favor.

Here’s how the right Realtor can make a difference:

- Identify homes that represent strong value before the competition spots them

- Negotiate a lower price or better terms based on market data

- Protect you with inspection and appraisal contingencies

- Request repair credits or closing-cost assistance to lower your out-of-pocket expenses

When you’re buying in a market like San Antonio, where every dollar counts, having a knowledgeable advocate by your side isn’t optional it’s essential.

The Bottom Line

Buying a home isn’t just about finding a property you love it’s about making smart financial choices that keep your budget balanced for years to come.

Start by comparing lenders, then focus on improving your credit, planning your down payment, and working with an experienced San Antonio agent who can help you navigate every step with confidence.

With the right strategy, you’ll not only buy a home you’ll build lasting financial peace of mind.

Categories

Recent Posts

"Molly's job is to find and attract mastery-based agents to the office, protect the culture, and make sure everyone is happy! "