4 Housing Myths Debunked This Week: Here’s What the Data Actually Says

Real data. Real clarity. Real peace of mind.

You know that moment at a holiday table when someone brings up the housing market and suddenly everyone has a hot take. Last week I found myself playing myth buster with actual numbers and watching the worry melt away as soon as the facts came out.

So, let’s walk through the questions buyers and homeowners in San Antonio are asking right now and what the data really says.

How is the housing market today

Nationally, the National Association of Realtors reports that October existing home sales rose more than 1% from the month prior and almost 2% year over year.

Here in the San Antonio area, the median sales price is holding strong around $310,000. That is steady and healthy.

Inventory tells the real story. Across the country supply remains tight. In San Antonio we have a little more breathing room. More than 6 months of inventory means buyers have choices, negotiating power, and the freedom to shop wisely.

Are home prices falling

Will this affect my equity

A recent Zillow stat made big headlines. It showed that just over half of homes across the country dipped slightly in value during the year. That sounds dramatic without context, so let’s add the context.

- Values soared for 6 straight years. A gentle recalibration is normal

• The typical dip from peak value is less than 10%, nothing like the deep drop seen after the Great Recession

• Only a tiny share of homeowners are below their original purchase price

• Most homeowners have seen equity climb significantly over time, with an average value gain of more than 60% since purchase

If you are planning to stay in your home or thinking ahead strategically, a small adjustment on a Zestimate does not erase years of wealth growth. San Antonio homeowners are still sitting on solid equity.

What about foreclosures

Is another crash coming

Foreclosure activity has inched up, and that is what you have likely seen in headlines. The latest ATTOM report shows foreclosures increasing on both a month and year basis. This is the 8th month in a row that year over year totals have risen.

The missing piece in the headlines is that we are rising from historically low levels. Repossessions are still extremely low. Many of the markets with higher counts are showing backlog clearing and reporting delays rather than a sudden wave of major distress.

Still, we cannot ignore what many households are feeling. The pressure from rising insurance costs, higher property tax bills, and the cost of everyday living is real.

But this environment is very different from the subprime lending era. Homeowners today have better loans, stronger qualification standards, and more equity. When someone here in San Antonio is in a financial pinch, there are options long before foreclosure ever becomes a possibility. I help people in that position all the time and can help you too.

What is the deal with a 50-year mortgage

The concept went viral because it sounds like a quick fix for affordability. Longer repayment means lower monthly payments. It captured attention online, but it is not actually available under current federal mortgage rules. Qualified Mortgage guidelines cap the term at thirty years. That would have to change first.

Even if it became possible, stretching payments over fifty years slows equity growth and greatly increases the lifetime interest paid. For now, this remains an idea circulating in conversation, not in your lender’s toolbox.

Could I ever take my mortgage with me when I move

This is called mortgage portability. It would allow you to keep your existing interest rate by taking your current loan to your next home. Homeowners with two to three percent rates love the thought.

Regulators are exploring the concept and have acknowledged the appeal. The challenge is that most existing loan documents are written to prevent portability. Until a major policy change happens, lenders cannot transfer your mortgage to a new property. If that changes, I will be the first to share what it means for San Antonio buyers and sellers.

What is expected for the year ahead

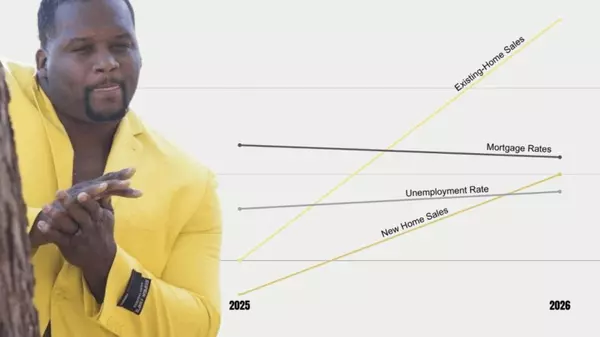

The newest forecast from the National Association of Realtors offers a positive outlook for the next two years.

- Home sales are projected to increase more than 10%

• Prices are expected to continue rising at a steady pace

• Mortgage rates are predicted to drift closer to 6%

• Loan applications are already climbing which signals growing consumer confidence

In simple terms, the housing market is moving toward more activity, healthy appreciation, and slightly easier financing conditions compared to this year.

What this means if you live in San Antonio

or are planning to

Whether you are budgeting to buy, curious about your equity, or planning a move, the best decisions come from clear data not scary headlines.

If you have a question this blog did not answer, I am always here to talk through your situation and provide trusted market guidance tailored to San Antonio. Send me a message anytime and I will help you navigate your next step with confidence.

Categories

Recent Posts

"Molly's job is to find and attract mastery-based agents to the office, protect the culture, and make sure everyone is happy! "