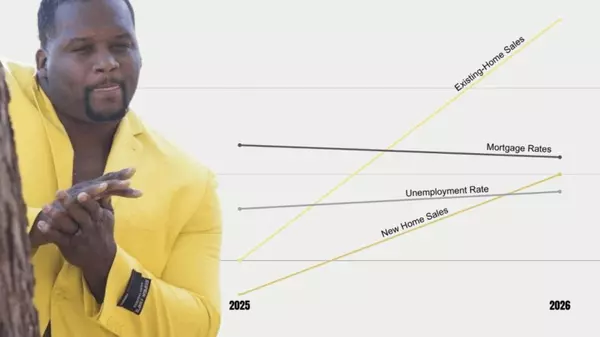

Mortgage Rates Dip—Even Though Inflation Rose. What Gives?

If you're watching mortgage rates like a hawk (👀), Friday brought a small but surprising piece of good news: rates ticked slightly lower—even though they technically weren't supposed to.

Before we pop the champagne, let’s put it in perspective: the average 30-year fixed mortgage rate still hovers near the upper end of its recent range, closer to 6.75%, and that range has been tight for several weeks. So while the dip is welcome, it’s nothing major… yet.

Why the Drop Matters

The biggest shocker? Rates went down on the same day the PCE inflation report showed inflation had risen. Wait, what?

This kind of inflation report usually pushes mortgage rates up, not down. That’s because higher inflation erodes the value of bonds, leading investors to demand higher returns—aka, higher interest rates. So why the curveball?

What’s Really Going On?

Let’s break down what might have caused the unexpected dip:

🔹 1. The Inflation Numbers Were “Technically” Not That Bad

The PCE numbers may have looked worse on paper, but that’s mostly due to rounding. When looking at the unrounded data, inflation came in very close to expectations. That subtle difference calmed market nerves.

🔹 2. The Stock Market Took a Tumble

Stocks and mortgage rates often move in opposite directions, especially when investors flee risky assets (like stocks) for safer ones (like bonds). That’s what happened on Friday: stocks dropped significantly, and bond prices rose—bringing rates down with them.

🔹 3. End-of-Quarter Market Movements

There’s a third, more technical factor at play: month-end and quarter-end trading. Big institutional investors often rebalance their portfolios during these times, which can create temporary shifts in bond markets and mortgage rates—even without any big economic news.

Since Monday is the last day of both the month and the quarter, some of Friday’s rate movement could just be traders wrapping things up for Q1.

Bottom Line for Homebuyers & Sellers

- Yes, rates dipped—but just a little.

- No, it doesn’t mean we’re heading back to 5% rates tomorrow.

- However, it shows how sensitive the mortgage market is to both economic data and investor behavior.

If you’re a buyer or seller in San Antonio, this is a great time to stay in close contact with your lender or agent (hi, I’m Kristen 👋). A small rate drop can mean a noticeable change in your monthly payment—so being ready to act can give you an edge.

Need help navigating the current housing market or mortgage options in San Antonio?

Let’s connect—I’ve got the local insights and lending partners to help you make the smartest move.

Kristen Smith, Realtor Best San Antonio Realtor

Categories

Recent Posts

"Molly's job is to find and attract mastery-based agents to the office, protect the culture, and make sure everyone is happy! "