January 2025 Inflation Report: What It Means for Housing, Energy, and Consumer Prices

As inflation continues to shape economic conditions in 2025, the latest Consumer Price Index (CPI) report from the U.S. Bureau of Labor Statistics (BLS) highlights key trends that affect housing, energy, and consumer prices across the nation. With a 0.5% increase in CPI for January, bringing the 12-month inflation rate to 3.0%, economic analysts and consumers alike are closely monitoring what this means for their daily expenses and future financial planning.

Key Takeaways from the CPI Report

Inflation Trends in January 2025

- Overall CPI-U (Consumer Price Index for All Urban Consumers) rose 0.5% in January.

- 12-Month Inflation Rate: 3.0% (up from 2.9% in December).

- Shelter costs increased 0.4%, marking a 4.4% rise over the last 12 months—the slowest annual increase since January 2022.

- Energy prices rose 1.1%, with gasoline prices increasing by 1.8%.

- Food prices rose 0.4% in January and 2.5% over the past year, with egg prices surging 15.2%, marking the biggest monthly jump since June 2015.

Housing Market and Inflation: Powell's Congressional Testimony

During his Monetary Policy Report to Congress, Federal Reserve Chair Jerome Powell addressed concerns over inflation, housing affordability, and mortgage rates. Powell stated that while the housing market had shown signs of stabilization, mortgage rates remain high due to long-term bond rates, rather than direct Fed policy.

Key Points from Powell’s Testimony:

- The Federal Reserve remains committed to its dual mandate of maximum employment and stable prices.

- Housing market activity has stabilized, but mortgage rates are still high, making home affordability a growing concern.

- Mortgage rates are more influenced by long-term bond rates (such as the 10-year and 30-year Treasury yields) than the Federal Reserve’s short-term rate policy.

Housing Affordability Challenges Persist

Powell’s statements suggest that even if the Federal Reserve begins to lower interest rates later this year, mortgage rates may not drop significantly. Factors such as:

- High construction costs

- Labor shortages

- Rising material prices

- Limited housing supply

are contributing to long-term affordability issues in the U.S. housing market.

Mortgage Applications on the Rise

Despite high interest rates, mortgage applications increased by 2.3% in the first week of February, according to the Mortgage Bankers Association (MBA).

Mortgage Market Trends:

- Refinance applications surged 10%, marking the strongest week since October 2024.

- Purchase applications were up 2% year-over-year.

- Average loan size for purchases reached $456,100, the highest since March 2022.

- 30-Year Fixed Mortgage Rate: 6.95% (slightly down from 6.97%).

What This Means for Homebuyers

With home prices still elevated and interest rates expected to remain high for now, prospective buyers may need to weigh their options carefully. While some may choose to wait for potential rate cuts, others are securing loans now, anticipating refinancing opportunities in the future.

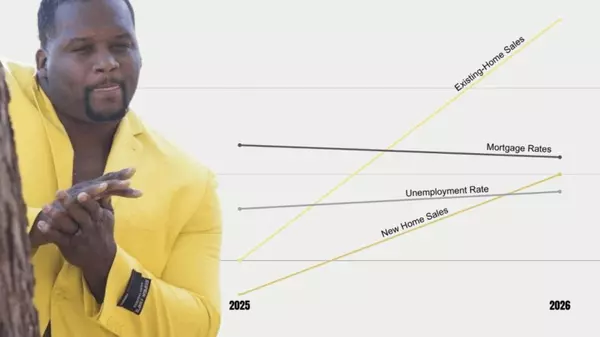

The Future of Inflation and Housing Affordability

Looking ahead, Powell and other financial experts acknowledge that housing affordability will remain a challenge, even after inflation stabilizes. Issues such as rising insurance costs due to extreme weather events and regional housing shortages will continue to shape the market in the years ahead.

Powell warned that some areas of the country may become increasingly difficult to insure or finance due to climate-related risks, which could have long-term impacts on the mortgage market and overall property values.

Key Takeaways:

- Inflation rose to 3.0% in January 2025, driven by increases in housing, energy, and food prices.

- The housing market has stabilized, but affordability remains a major concern due to high mortgage rates and supply shortages.

- Mortgage applications are rising, with borrowers looking for opportunities to secure loans despite high interest rates.

- Housing affordability is expected to remain a challenge, with long-term inflation trends influencing homeownership accessibility.

As we move further into 2025, homebuyers, renters, and policymakers will need to navigate the evolving economic landscape to ensure sustainable housing solutions for the future.

Kristen Smith, Realtor Best San Antonio Realtor

Categories

Recent Posts

"Molly's job is to find and attract mastery-based agents to the office, protect the culture, and make sure everyone is happy! "