Is the 2% Inflation Target Still Realistic in Today’s Economy?

For decades, the Federal Reserve has aimed for a 2% inflation target, considering it the sweet spot for economic stability. But in today’s economic climate—with ongoing supply chain disruptions, labor market shifts, and rising consumer costs—many are asking: Is 2% inflation still a reasonable goal, or has the economy outgrown this benchmark?

Let’s explore the origins of the 2% inflation target, why it was implemented, and whether it’s still achievable in today’s evolving economy.

Why 2%? The History Behind the Target

The idea of a formal inflation target began taking shape in the 1990s, when economists like Marvin Goodfriend and Fed officials like Alan Greenspan and Ben Bernanke debated the benefits of transparency in monetary policy. The goal was to provide predictability for financial markets and ensure that inflation did not spiral out of control.

In 2012, the Federal Open Market Committee (FOMC) officially adopted a 2% target for inflation, measured by the Personal Consumption Expenditures (PCE) Price Index. The reasoning was simple:

- Low enough to prevent runaway inflation.

- High enough to avoid deflation and allow the Fed flexibility in monetary policy.

- Stable enough to provide businesses and consumers with economic certainty.

However, in the wake of economic shocks like the COVID-19 pandemic, supply chain issues, and geopolitical instability, many are questioning whether the Fed’s longstanding 2% goal still makes sense.

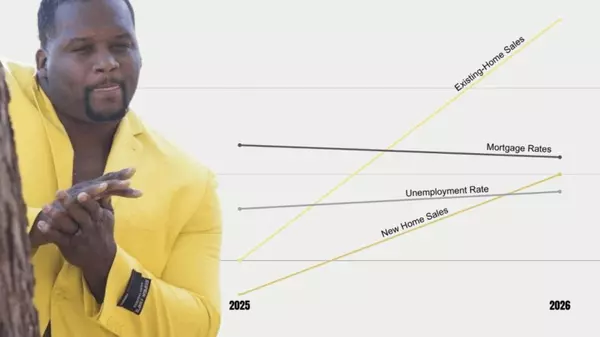

Can We Get Back to 2% Inflation?

Federal Reserve Chair Jerome Powell recently acknowledged the difficulty of bringing inflation down to 2% in today’s economy. While the Fed has raised interest rates aggressively to cool inflation, the reality is that several factors could prevent us from reaching this historical benchmark.

- Persistent Supply Chain Challenges

Many of the inflationary pressures we’ve seen in recent years stem from supply chain disruptions that remain unresolved. Whether it’s global shipping constraints, semiconductor shortages, or rising energy prices, supply-side issues continue to put upward pressure on costs.

- A Tight Labor Market

The labor market remains historically strong, and wage growth has outpaced inflation in several industries. When wages continue rising, businesses often pass those costs onto consumers, making it harder to bring inflation down to the Fed’s target.

- High Consumer Spending

Despite inflation and higher interest rates, consumer demand has remained surprisingly resilient. Strong spending keeps prices elevated, making it harder for inflation to return to the Fed’s 2% goal.

Should the Fed Rethink the 2% Target?

Many economists now argue that a higher inflation target—perhaps 3% or 4%—might be more realistic in the current environment. A higher target would allow for more flexibility and reduce the risk of overly restrictive policies that slow down economic growth.

Others, however, believe that abandoning the 2% target could damage the Fed’s credibility and cause inflation expectations to spiral, leading to higher borrowing costs and market volatility.

Final Thoughts: Is 2% Inflation Achievable?

While reaching 2% inflation remains the Fed’s official goal, achieving it may be more difficult than ever due to structural economic changes, global uncertainties, and a tight labor market.

The question remains: Should we adjust our expectations and allow for slightly higher inflation, or continue aggressive policies to reach an outdated benchmark?

Only time will tell, but one thing is certain—the debate over the Fed’s inflation target isn’t going away anytime soon.

Categories

Recent Posts

"Molly's job is to find and attract mastery-based agents to the office, protect the culture, and make sure everyone is happy! "