Texas Propositions That Impact Homeowners and Property Taxes | What San Antonio Homeowners Should Know

This November, Texans will be voting on 17 constitutional amendments, but only a handful truly impact homeowners and property taxes. As a San Antonio Realtor, I’ve gone through each one to help you focus on the amendments that actually matter for your wallet and your home.

If you’re a Texas homeowner, veteran, or retiree, here’s what you need to know before heading to the polls.

🔹 Proposition 13 – Increasing the General Homestead Exemption

This is the big one. Proposition 13 would raise the Texas homestead exemption from $100,000 to $140,000 for school district property taxes.

That means a larger portion of your home’s value is not taxable, directly lowering your annual property tax bill. For most Texas homeowners, this equals an estimated $400–$500 in yearly savings.

Why it matters for San Antonio:

- Home values in Bexar County have climbed sharply in recent years, and this higher exemption helps offset those increases.

- The exemption applies to your primary residence — so if you’ve declared your San Antonio home as your homestead, this one hits home.

🔹 Proposition 11 – More Property Tax Relief for Seniors and Disabled Homeowners

If you’re 65 or older or have a disability, this amendment could make a noticeable difference. Proposition 11 raises the homestead exemption for these homeowners from $10,000 to $60,000 on top of the general homestead exemption.

That’s meaningful relief for anyone on a fixed income and it ensures Texas seniors can stay in their homes longer without being priced out by rising property taxes.

🔹 Proposition 10 – Temporary Property Tax Exemption for Homes Destroyed by Fire

This one offers a temporary exemption for homeowners whose homes are destroyed by fire. Under current law, if your home burns down mid-year, you still owe taxes based on its original value. Proposition 10 would fix that for an adjusted or reduced tax bill for that tax year.

It’s a small change that makes a big difference for anyone rebuilding after disaster.

🔹 Proposition 7 – Full Property Tax Exemption for Surviving Spouses of Veterans

As a veteran myself, this one hits close to home. Texas already provides a full property tax exemption to the surviving spouse of a service member killed in action.

Proposition 7 expands that to include surviving spouses of veterans who die from service-connected conditions such as exposure to burn pits, Agent Orange, or other military-related illnesses.

It’s a powerful acknowledgment that sacrifice doesn’t always end on the battlefield — and that military families deserve continued support.

🏠 What These Mean for Texas Homeowners

If these propositions pass, they’ll bring tangible property tax relief across Texas especially in fast-growing areas like San Antonio, Cibolo, Schertz, and New Braunfels.

Lower property taxes not only make homeownership more affordable but also boost the overall real estate market by improving buyer affordability and long-term stability.

For homeowners, it’s essential to:

✅ Review your homestead exemption status with your county appraisal district.

✅ Reapply or update exemptions if you’ve moved recently.

✅ Stay informed about how these new laws will affect your escrow payments and monthly mortgage.

Not every ballot item affects homeowners but these four (Propositions 7, 10, 11, and 13) absolutely do. They represent real opportunities for tax relief and stronger support for veteran families, seniors, and those rebuilding after loss.

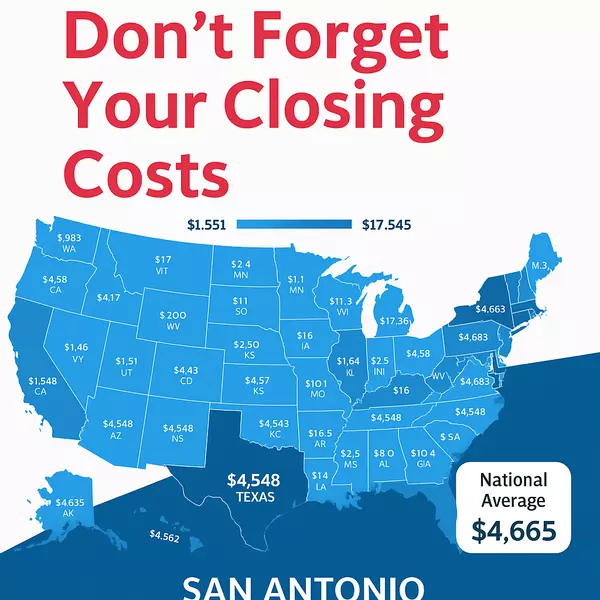

If you’re planning to buy or sell a home in San Antonio, understanding these changes will help you make smarter decisions about timing, budgeting, and your long-term financial picture.

I’m Kristen Smith, San Antonio’s Veteran Realtor, and I’m here to help you navigate not just the real estate market but the policies that impact it.

📞 Have questions about your property tax exemptions or how these changes affect your home value?

Let’s connect.

Categories

Recent Posts

"Molly's job is to find and attract mastery-based agents to the office, protect the culture, and make sure everyone is happy! "