San Antonio Homebuyers: Don’t Forget Closing Costs When Saving for a Home

Saving to Buy a Home? Don’t Forget Your Closing Costs

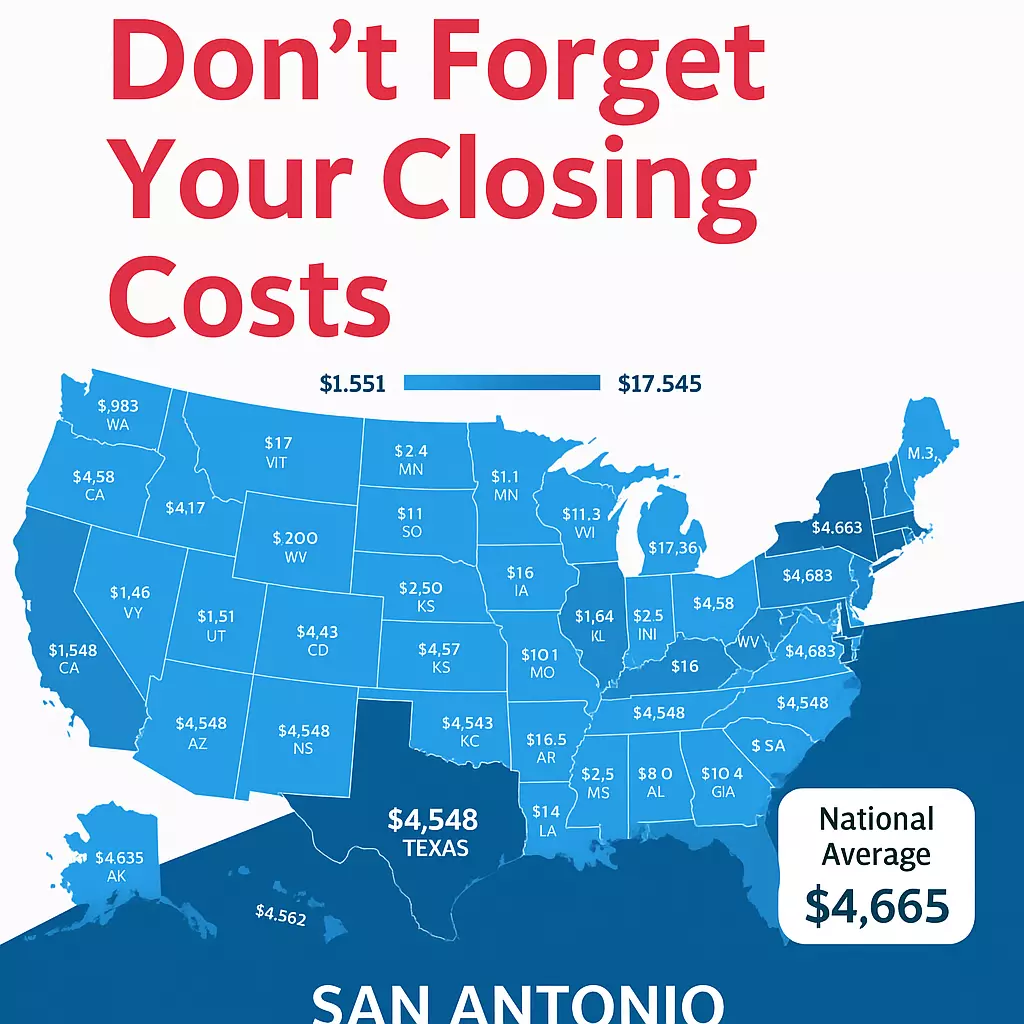

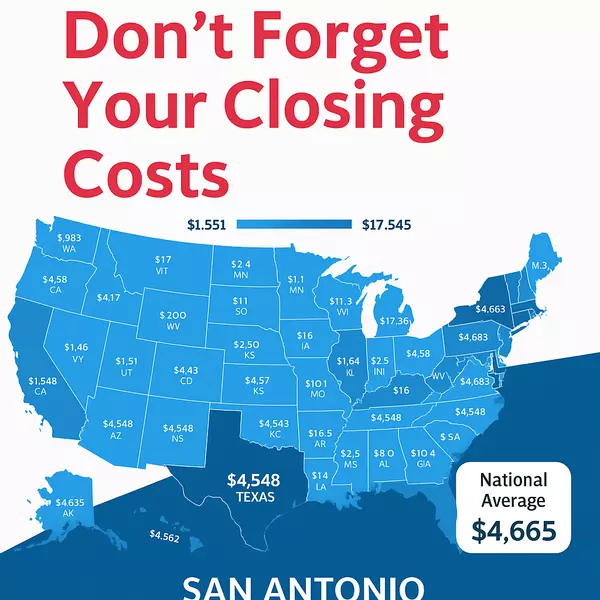

Most buyers save for their down payment, but many underestimate what closing costs will add to the bill. And these aren’t the same everywhere. In some states, closing costs average $2,000 to $3,000. In others, like Washington D.C., they can top $17,000.

This map of typical closing costs by state shows just how big the differences can be. Use it as a rough guide, but the only way to know your real number is to work with a local San Antonio agent and lender.

What Exactly Are Closing Costs?

Closing costs are the additional fees and charges due when you finalize your home purchase. They’re standard for every buyer. According to Freddie Mac, these may include:

- Loan application and origination fees

- Credit report

- Appraisal and inspection fees

- Title search and title insurance

- Property survey (if required)

- Attorney and settlement services

- Recording fees and property taxes

- Homeowners insurance (pre-paid in advance)

Think of it this way: your down payment gets you into the home, but your closing costs are what make the deal official.

National vs Local: Why Costs Vary So Much

Online sources often say “closing costs equal 2 % to 5 % of the home price.” That’s a helpful starting point, but it doesn’t tell the whole story.

The real amount depends on:

- Local tax rates and transfer fees

- County recording fees

- Title company charges

- Attorney or settlement costs

- Insurance premiums in your area

That’s why your San Antonio closing costs may look different than someone buying in Austin, Dallas, or even New York.

Closing Costs in Texas and San Antonio

Here’s what you need to know locally:

- Texas buyers usually pay between 2 % and 5 % of the purchase price in closing costs.

- Bankrate estimates Texas buyers average around $4,548, roughly 1.5 % of a typical home price.

- San Antonio sellers often cover the owner’s title insurance and escrow/closing fees, which run 2 % to 4 % of the sales price.

- HOA communities are common in San Antonio — about 71 % of homes listed in the city have HOA fees. That means you may see HOA transfer or resale fees built into your closing.

- Unlike many states, Texas does not have a state transfer tax, which helps keep our closing costs a bit lower compared to other states.

For example: on a $350,000 home in San Antonio, 3 % in closing costs would add up to $10,500 on top of your down payment.

How to Reduce Your Closing Costs

You may not be able to avoid closing costs, but you can lower them. Some strategies include:

- Asking the seller for a closing cost credit

- Shopping for competitive title companies and insurance providers

- Negotiating lender fees like underwriting and origination

- Exploring down payment and closing cost assistance programs in Bexar County

- Double-checking your settlement sheet for errors

Bottom Line

Closing costs are one of the most overlooked parts of buying a home. They vary greatly depending on your location, loan type, and purchase price. Planning ahead makes the process smoother and can save you thousands.

If you’re planning to buy in San Antonio, let’s look at your price range and get you a personalized estimate of closing costs. That way you can budget with confidence and move into your new home stress-free.

📲 DM me today or visit soldbykristensmith.com to get started.

Categories

Recent Posts

"Molly's job is to find and attract mastery-based agents to the office, protect the culture, and make sure everyone is happy! "