Should You Wait for a Recession to Buy a Home? A San Antonio Realtor Weighs In

The economy feels like it's on a rollercoaster — from inflation cooling off to stock market swings and rising global tensions. With mortgage rates still hovering around 6.7%, many buyers in San Antonio are asking the same question: Should I wait for a recession to buy a home?

As a local San Antonio realtor, I’ve seen how economic shifts impact our market. The truth is, while a recession can bring opportunities for homebuyers, it’s not always the magical solution people hope for. Let’s explore what a recession means for mortgage rates, home prices, and why the timing of your home purchase should be based more on you than on market predictions.

Is a Recession Coming?

Technically, we’re not in a recession yet — but it sure feels like one. Layoffs are increasing, GDP growth is slowing, and grocery bills still sting. San Antonio hasn’t been immune to these trends. While our job market is stronger than some metro areas, rising property insurance and utility costs have squeezed homeowners and renters alike.

And here’s the thing: A recession doesn’t stop the housing market. It just shifts it. If you're prepared, that shift could actually work in your favor.

Will Mortgage Rates Drop During a Recession?

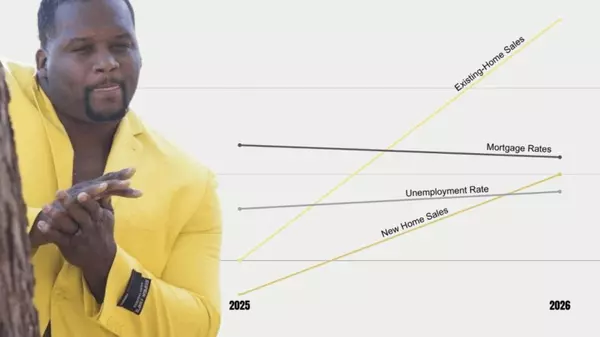

Historically, mortgage rates do drop in recessions — we saw this in 2020 and during the 2008 crash. But in 2025, things are more unpredictable. Even if the Federal Reserve cuts rates, mortgage rates may not fall drastically. Many rate cuts are already "priced in" by lenders, so the impact might be limited.

San Antonio Insight:

Here in San Antonio, the average 30-year fixed rate has stayed around 6.7% in early 2025 — still high by pandemic standards, but lower than the peak of over 8% in late 2023. Despite this, we're seeing more buyer activity, especially from locals tired of renting and veterans using their VA benefits to purchase homes.

Will Home Prices Drop in a Recession?

This is the million-dollar question — and the short answer is: probably not by much.

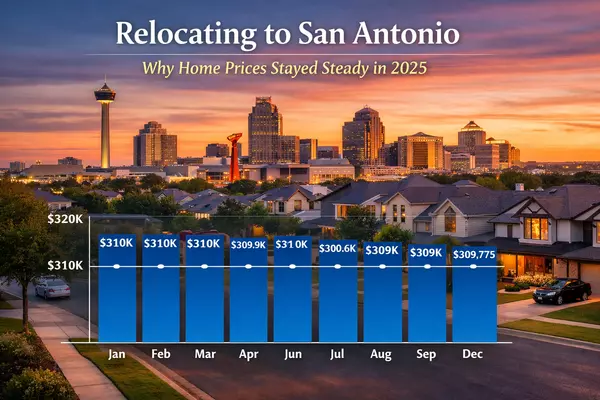

The 2008 crash was an outlier. Typically, home prices plateau or see minor dips during a recession. In San Antonio, we’ve seen a slight decline in home prices — the median price dropped to $290,000, down from the highs of 2022-2023. However, we’re still dealing with tight inventory, which keeps prices relatively stable.

And while homes are staying on the market longer (around 83 days on average), that gives buyers a bit more breathing room and negotiating power.

Can You Get a Better Deal in a Recession?

Yes, if you’re financially stable, a recession can work in your favor. Fewer buyers = less competition = better deals. You might find sellers more willing to negotiate on price, offer closing cost credits, or accept inspection requests they’d normally reject in a hot market.

San Antonio Insight:

Some areas of the city, like Government Hill, Midtown, and parts of the East Side, are showing more price reductions and increased days on market. These can be great opportunities for buyers who are ready and pre-approved.

What If You're Waiting for 4% Interest Rates Again?

That may be a long wait. Unless we see a major economic collapse (which no one is rooting for), it’s unlikely we’ll return to those ultra-low rates anytime soon. Experts believe the “new normal” for interest rates will likely settle in the 6%–7% range through most of 2025.

The Bottom Line: Buy When It’s Right for YOU

If you’ve got:

✅ Steady income

✅ A solid down payment

✅ Strong credit

✅ A plan to stay in your home for 5+ years

…then now could be the right time to buy — even in an uncertain economy.

Waiting for the “perfect moment” often leads to missing out. Prices might not drop. Rates might not change. And in the meantime, rent payments keep going up.

Final Thoughts from San Antonio

Here in Military City USA, we know a thing or two about resilience. Our local economy is supported by major employers like USAA, Joint Base San Antonio, the South Texas Medical Center, and a fast-growing tech and tourism sector. While no city is recession-proof, San Antonio’s housing market remains steady — and full of opportunity for prepared buyers.

So, should you wait for a recession to buy a home? Maybe. But don’t wait too long — because in real estate, timing the market is never as powerful as time in the market.

Thinking about buying in San Antonio?

Let’s talk. I’d love to help you understand your options, run the numbers, and decide whether now’s the right time for you.

Kristen Smith, Realtor San Antonio best Realtor

Categories

Recent Posts

"Molly's job is to find and attract mastery-based agents to the office, protect the culture, and make sure everyone is happy! "