How Much House Can I Afford in San Antonio?

Buying a home in San Antonio is an exciting step—but figuring out how much house you can afford is just as important as finding the right neighborhood. While your lender will tell you what you're pre-approved for, that number doesn’t always reflect what you can comfortably afford long-term.

Let’s walk through what really goes into home affordability—and how you can calculate a realistic monthly payment that fits your lifestyle here in San Antonio.

🧮 How to Calculate What You Can Afford

Your mortgage affordability is based on several key factors:

- Gross Income (your pay before taxes)

- Down Payment (the more you put down, the more you can borrow)

- Monthly Debt (student loans, credit cards, car payments)

- Credit Score (a higher score unlocks better rates)

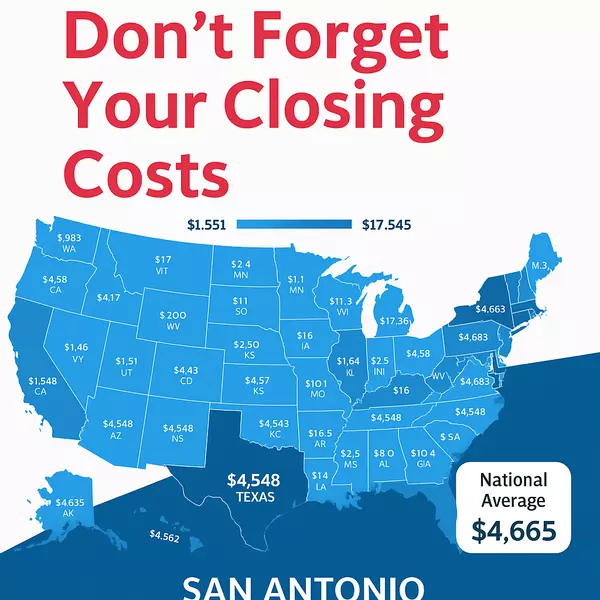

- Additional Costs (property taxes, homeowners insurance, and HOA dues)

💡 San Antonio Tip: In Bexar County, average annual property taxes hover around 2.1% of your home’s assessed value. For a $325,000 home, that’s about $6,825/year or $570/month—a key factor to include when estimating your mortgage payment.

🔢 What Is the 28/36 Rule?

Most lenders follow the 28/36 Rule to evaluate what you can afford:

- 28% Rule: No more than 28% of your gross monthly income should go toward housing costs (mortgage, taxes, insurance).

- 36% Rule: Your total monthly debt payments—housing included—should not exceed 36% of your gross income.

Example:

Let’s say your monthly gross income is $6,000.

- Your ideal housing budget would be $1,680/month (28%).

- Your total debt (including mortgage) shouldn’t go over $2,160/month (36%).

However, don’t forget what matters most: your comfort level. Just because a lender says “yes” doesn’t mean the monthly payment fits your lifestyle.

💳 The Role of Debt-to-Income Ratio (DTI)

Your DTI ratio = monthly debt payments ÷ monthly gross income.

Lenders use this ratio to assess risk. A lower DTI increases your chances of approval—and may get you better interest rates. While most conventional loans max out at 36-45% DTI, VA and FHA loans may allow up to 55% in certain cases.

💡 San Antonio Tip for Veterans: Many of my VA clients are surprised to find how flexible DTI ratios can be. If you're using a VA loan, reach out—I'll help you estimate your true buying power without maxing out your budget.

💵 What About Your Down Payment?

Ideally, you’d put down 20% to avoid PMI (private mortgage insurance), but don’t stress if you can’t. There are plenty of options for buyers in San Antonio:

- FHA Loans: 3.5% down

- Conventional Loans: As low as 3%

- VA Loans: $0 down for qualified buyers

💡 Local Insight: The median home price in San Antonio is currently around $315,000. A 20% down payment would be $63,000—but with VA and first-time buyer programs, you may need far less to get into your new home.

📉 How Do Interest Rates Affect Affordability?

Interest rates can dramatically change your monthly payment. For example:

- $300,000 mortgage @ 6% = ~$1,800/month (P&I)

- $300,000 mortgage @ 7% = ~$1,995/month (P&I)

That $195/month difference adds up to over $70,000 across 30 years!

💡 San Antonio Market Tip: While rates have been hovering above 6% for the last couple years, some local builders (like DR Horton or Lennar) offer rate buydowns or incentives—especially in communities outside Loop 1604.

🛠️ Use a Mortgage Calculator (and Local Expertise)

Online affordability calculators are a great place to start, but they can’t factor in every nuance—like San Antonio’s unique property tax rates, HOA fees, or new build incentives. When you're ready to run the real numbers, I can connect you with trusted local lenders who understand the Bexar County market.

🎯 Final Advice: Stay Within Your Comfort Zone

Lenders might approve you for more than you need—but you’re the one making that payment every month. Consider:

- Saving room for emergencies, retirement, and vacations

- Not exceeding 25% of your take-home pay for housing (a more conservative, smart strategy)

- Budgeting for costs like lawn maintenance, utilities, and ongoing repairs

🏡 Ready to See What You Can Afford in San Antonio?

Whether you’re just starting your home search or narrowing down your options, I’m here to help you make confident, informed decisions.

Let’s connect, crunch the numbers, and find a home that fits you—not just your preapproval letter.

Categories

Recent Posts

"Molly's job is to find and attract mastery-based agents to the office, protect the culture, and make sure everyone is happy! "