Bexar County Property Tax Timeline: Key Dates for 2025 Every Homeowner Should Know

Property tax season in San Antonio is more than just checking your mailbox—it's about being prepared and proactive. Whether you're a seasoned homeowner or this is your first year navigating taxes in Bexar County, understanding the 2025 property tax timeline can save you time, money, and stress.

Let’s break down the key dates and action items every property owner in Bexar County needs to know this year.

🗓 Why the Timeline Matters

Protesting your property taxes can lead to real savings—but timing is everything. From your appraisal notice to appeal hearings and payment deadlines, every step is tied to a firm date. Missing one could mean missing your chance to lower your tax bill.

📅 2025 Bexar County Property Tax Calendar

January 1: Appraisal Date

The Bexar Appraisal District (BCAD) uses this date to assess your property’s market value. If you're protesting, all your evidence should reflect your property’s condition as of January 1, 2025.

April: Appraisal Notices Mailed

Keep an eye on your mailbox in early to mid-April. Review your notice carefully for accuracy and compare it with last year’s assessment.

Tip: Look for errors in square footage, renovations, or comparable sales.

May 15 (or 30 Days After Notice): Protest Deadline

File your protest before May 15—or 30 days after the date your appraisal notice was mailed, whichever is later.

How to protest:

- Online at BCAD.org

- By mail: PO Box 830248, San Antonio, TX 78283

- Drop-off: 411 N. Frio Street, San Antonio, TX 78207

June–July: Informal Reviews & ARB Hearings

Informal meetings are held virtually or by phone. If your case isn’t resolved informally, it proceeds to the Appraisal Review Board (ARB).

ARB Hearings Options:

- Phone call

- Written affidavit

- Zoom (Virtual Hearing)

- In-person (by request)

October: Tax Rates Finalized

Local tax entities set final rates for the year. Note: You can protest your value, but not the tax rate itself.

November: Tax Bills Issued

Prepare to pay even if you’re still appealing. You’ll get your tax bill once rates are finalized.

January 31, 2026: Payment Deadline

This is the last day to pay your 2025 taxes without penalties.

📋 Summary of 2025 Key Dates

- Jan 1: Property valuation date

- April: Appraisal notices mailed

- May 15: Protest deadline

- June–July: Hearings and informal reviews

- October: Final tax rates set

- November: Tax bills mailed

- Jan 31, 2026: Final payment deadline

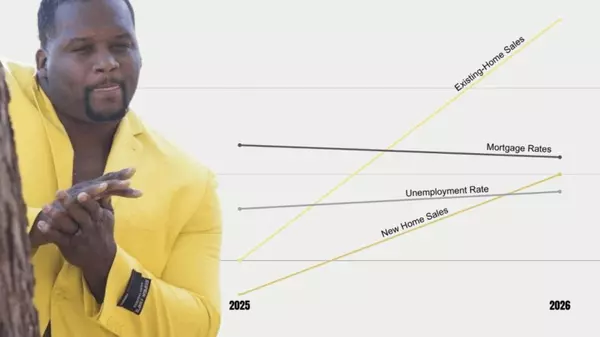

📣 What’s New for 2025 & 2026 in San Antonio

BCAD has adopted a two-year reappraisal plan with new guidelines:

✅ If your 2024 market value was lowered through a protest, that value will be the basis for 2025 unless there’s strong evidence to adjust it.

✅ If no major changes occur to your property, the 2025 protest outcome may carry into 2026 as well.

✅ New language ensures transparency and consistency when reevaluating protested properties.

This is especially significant for San Antonio residents protesting values in rapidly changing neighborhoods like Government Hill, Denver Heights, and the Medical Center area.

🔍 Know Your Property Values

Your notice of appraised value includes:

- Market value (sales value)

- Assessed value (after exemptions like homestead)

- Taxable value (used to calculate taxes)

Don’t receive a notice? Use BCAD’s online property search to view your valuation.

Kristen Smith, Realtor best Realtor in San Antonio

Final Thoughts

Protesting your Bexar County property tax is a right, not a hassle. With proper timing, organization, and a little help, you can significantly reduce your tax burden. Mark your calendars, gather your evidence, and don't miss out on your chance to save.

Categories

Recent Posts

"Molly's job is to find and attract mastery-based agents to the office, protect the culture, and make sure everyone is happy! "