Bexar County Appraisal Notices Are Out—Here’s Why You Need to Protest in 2025

Homeowners in Bexar County are starting to receive their 2025 appraisal notices, and the numbers are in: property values have gone up by an average of 2.1%. The Bexar Appraisal District calls it a “modest” increase, especially compared to the explosive spikes of recent years.

But let’s break this down—and get real about what’s happening 👇

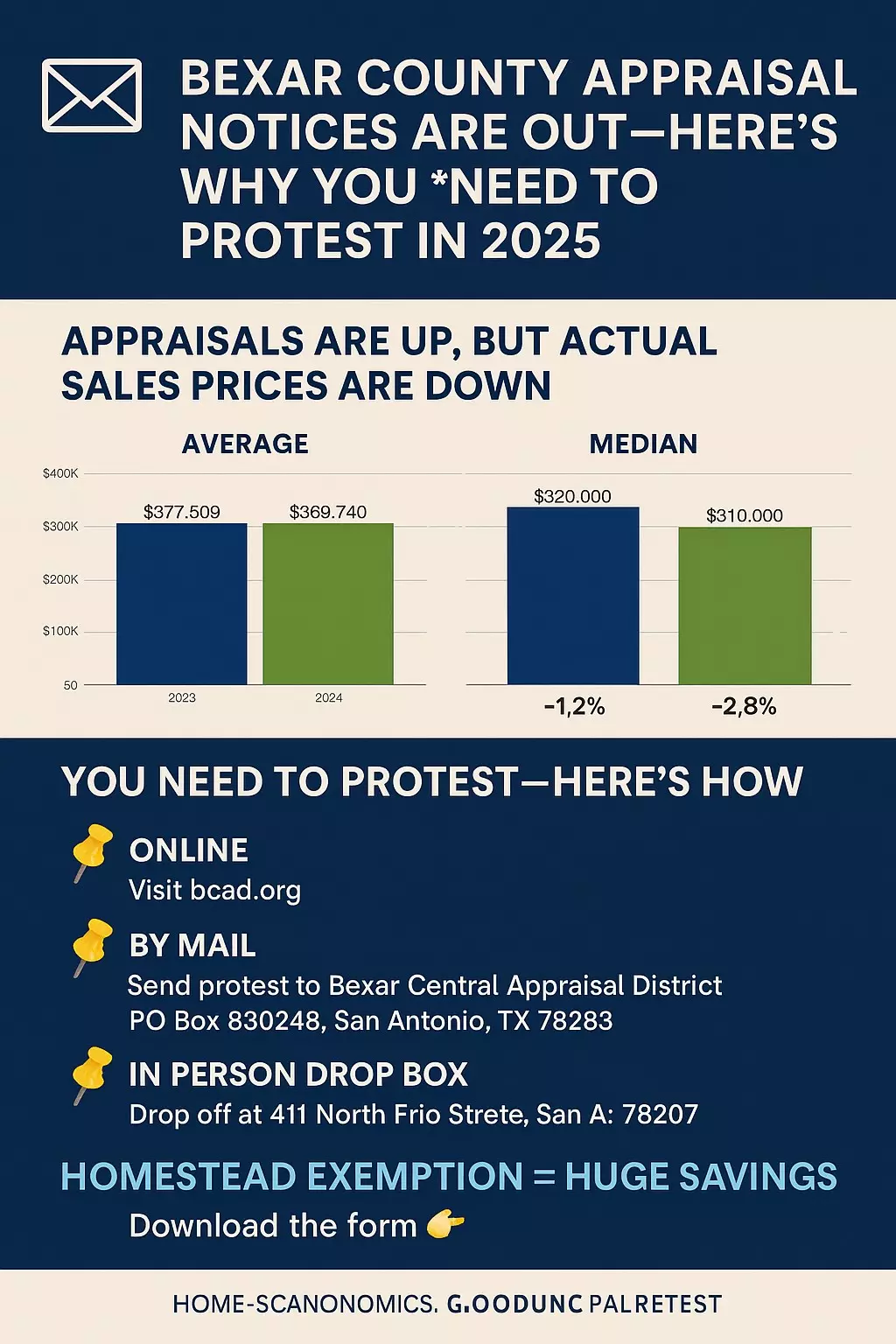

💡 Appraisals Are Up, But Actual Sales Prices Are Down

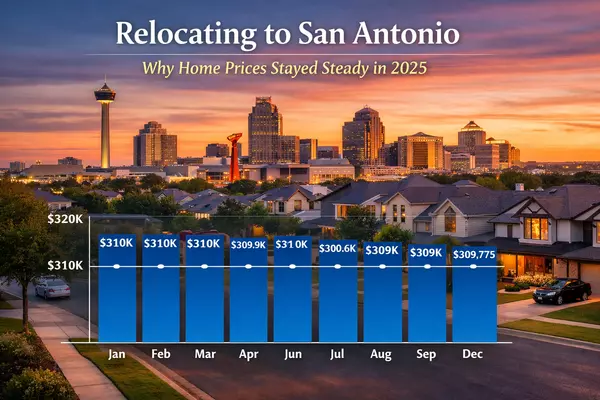

Despite the 2.1% increase in assessed values, the actual real estate market tells a different story.

📉 According to 2024 sales data:

- The average home sale price in Bexar County dropped from $348,049 in 2023 to $343,801 in 2024, a -1.2% decrease.

- The median sale price also slipped from $303,595 in 2023 to $295,000 in 2024, a -2.8% decline.

So if your appraisal notice shows your value going up, but homes around you are selling for less… you’re probably being overvalued.

🚨 Why This Matters

Your property taxes are directly based on the assessed market value listed on that notice. The higher the value, the more you pay—even if your home couldn’t sell for that price right now.

And while the average increase is 2.1%, many neighborhoods may be experiencing steeper hikes due to new construction and lagging data.

🧠 You Need to Protest—Here’s How

If your value increased by $1,000 or more, you should have received a notice in the mail. And if you think the value is too high, you have until May 15 (or 30 days from the date on your notice, whichever is later) to file a protest.

📌 Three Ways to File:

- Online

The easiest method. Head to bcad.org, create an account, and submit your protest using your property owner ID and PIN. - By Mail

Send your protest to:

Bexar Central Appraisal District

PO Box 830248

San Antonio, TX 78283 - In Person Drop Box

Drop off your paperwork at:

411 North Frio Street

San Antonio, TX 78207

✍️ Pro Tips for a Successful Protest

✔️ Compare your value to recent home sales in your area

✔️ Submit photos of your home’s current condition if it needs repairs

✔️ Highlight inaccuracies on your appraisal (square footage, lot size, etc.)

✔️ Work with a property tax protest service if you're unsure what to submit

🎁 Bonus: Win in 2025 and Skip Reappraisal in 2026

Here’s a win: if you successfully protest your value this year and don’t pursue arbitration or legal appeal, the market value you secure will carry over into 2026.

That means no new fight next year, unless you’ve made major improvements like adding a pool or garage.

🏠 Homestead Exemption = Huge Savings

If you own and live in your home, make sure you’ve filed for your homestead exemption. This helps:

- Lower your taxable value

- Cap yearly increases at 10%

- Qualify for other tax benefits

📝 Download the homestead exemption form here.

💬 Final Thoughts

This year may not feel like a market boom, but that doesn’t mean your taxes should quietly creep higher. The data says otherwise—and now is your chance to do something about it.

🗣️ Don’t wait. Protest now. Save later.

Need help gathering comps or preparing your protest?

I’m Kristen Smith, your San Antonio Realtor—here to help you navigate property values, protests, and everything in between.

📩 Reach out anytime. I’ve got your six.

Kristen Smith, Realtor San Antonio best Realtor

Categories

Recent Posts

"Molly's job is to find and attract mastery-based agents to the office, protect the culture, and make sure everyone is happy! "