Understanding Escrow Shortages: What Homeowners Need to Know

If you’re a homeowner with a mortgage, chances are you have an escrow account that helps manage your property taxes and homeowners insurance. While escrow accounts simplify these payments by bundling them into your monthly mortgage payment, many homeowners get confused when they receive notices about escrow shortages or overages.

Let’s break down what an escrow shortage is, what causes it, and how you can manage it proactively.

What Is an Escrow Account?

An escrow account is a holding account managed by your mortgage lender. It sets aside funds from your monthly mortgage payment to cover property taxes and homeowners insurance. When these bills are due, your lender pays them on your behalf, ensuring you stay current without having to manage multiple due dates.

By consolidating these costs, you only have one bill to worry about each month instead of dealing with separate tax and insurance payments.

What Is an Escrow Shortage?

An escrow shortage happens when your account doesn’t have enough funds to cover the actual tax and insurance costs due for the year. Your lender estimates how much you’ll need based on past payments, but changes in property taxes or insurance premiums can create a shortfall.

If your escrow account runs short, you will need to make up the difference—either as a one-time payment or by increasing your monthly mortgage payment.

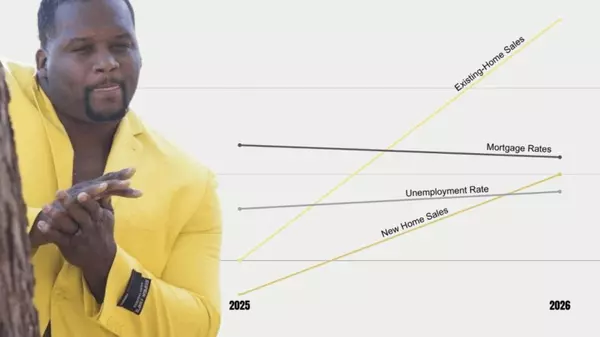

What Causes an Escrow Shortage?

Escrow shortages can occur when there are unexpected increases in property taxes or insurance premiums. Here are some common reasons this happens:

- Rising Property Taxes: If your home value increases, your property taxes may go up, requiring a larger escrow contribution.

- Insurance Premium Hikes: If your homeowners insurance company raises its rates, your escrow account may not have enough to cover the new cost.

- Incorrect Initial Estimates: If your mortgage lender underestimated your tax or insurance costs when setting up your escrow account, you might experience a shortage when bills are due.

- New Home Construction: If you built a new home, your initial tax assessment may have only accounted for the land value. Once reassessed with the home included, your tax bill could jump significantly.

Example of an Escrow Shortage

Let’s say your lender initially estimated your yearly taxes at $2,400 and your insurance at $1,200. Based on these estimates, your monthly escrow contribution would be $300 ($200 for taxes and $100 for insurance).

Now, if the actual tax bill comes in at $3,000 and the insurance increases to $1,600, that’s an additional $1,000 needed:

- Tax Shortage: $600 ($3,000 actual – $2,400 estimate)

- Insurance Shortage: $400 ($1,600 actual – $1,200 estimate)

- Total Escrow Shortage: $1,000

At this point, you will owe $1,000 to make up the difference and your monthly mortgage payment will increase to account for the higher escrow costs moving forward.

Escrow Shortage vs. Escrow Deficiency

An escrow shortage occurs when you have a positive balance in your account but not enough to cover the future tax and insurance bills.

An escrow deficiency happens when your lender has already paid your taxes or insurance by advancing funds on your behalf, leaving your escrow account with a negative balance. This means you not only owe for future payments but also need to repay your lender for the shortfall.

How Often Is Your Escrow Account Analyzed?

Your mortgage lender conducts an escrow analysis at least once a year to ensure the estimated payments align with your actual tax and insurance costs. However, if they detect significant changes, they may conduct an off-schedule analysis to prevent major shortfalls.

How to Manage an Escrow Shortage Proactively

While escrow shortages are sometimes unavoidable, there are steps you can take to better prepare:

- Monitor Property Tax and Insurance Trends: Keep an eye on local tax assessments and insurance rate increases. Your city or insurance company may notify you of changes in advance.

- Shop Around for Insurance: If your homeowners insurance premium increases, consider shopping for a better rate with different providers.

- Set Aside Extra Funds: Maintain an emergency fund to cover unexpected escrow shortages. A small savings cushion can prevent financial strain if your monthly mortgage payment increases.

- Opt for Higher Monthly Payments: Some lenders allow you to voluntarily increase your monthly escrow contributions to minimize the risk of shortages.

Why Is the Escrow Shortage Payment Higher Than the Shortage Amount?

Many homeowners are surprised when their escrow shortage payment is twice the actual shortage amount. This happens because your lender collects extra funds to prevent another shortage next year.

For example, if your homeowners insurance increased by $800, your escrow shortage payment might be $1,600:

- $800 covers the past increase

- $800 builds a buffer for next year’s insurance payment

This ensures you’re caught up for the current year and protected against similar increases in the future.

Does an Escrow Shortage Affect Your Mortgage Rate?

No. Your mortgage interest rate does not change due to an escrow shortage. However, your total monthly payment may increase because of higher escrow contributions for taxes and insurance.

If you have a fixed-rate mortgage, your principal and interest remain the same, but your total payment can fluctuate as tax and insurance costs change.

Bottom Line

Escrow accounts are designed to make homeownership easier by ensuring your property taxes and homeowners insurance are paid on time. However, fluctuations in taxes and insurance premiums can lead to escrow shortages, requiring homeowners to pay the difference and adjust their monthly mortgage payments.

To avoid unexpected financial strain, keep an eye on tax and insurance trends, shop for the best insurance rates, and consider setting aside extra funds for potential shortages. Being proactive can save you money and help you manage your mortgage payments with confidence.

Kristen Smith, Realtor Best San Antonio Realtor

Categories

Recent Posts

"Molly's job is to find and attract mastery-based agents to the office, protect the culture, and make sure everyone is happy! "