The Latest Federal Reserve Decision and Its Impact on the Housing Market

The Federal Reserve recently announced that it is keeping the federal funds rate unchanged at 4.25% to 4.50%, citing steady economic growth, a stable labor market, and persistent inflation concerns. This decision marks a key moment for the housing market, as buyers and sellers alike look for clues on how mortgage rates and home affordability might shift in the coming months.

With economic conditions remaining strong—GDP growth tracking at 2.3% for Q4 2024 and the unemployment rate staying low—the Fed is balancing inflation control with economic stability. While inflation remains above the 2% target, the Fed has removed previous language about inflation "making progress," signaling caution about future rate cuts.

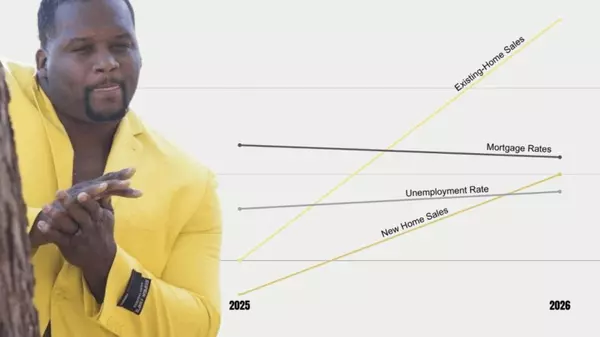

What Does This Mean for Mortgage Rates?

Mortgage rates are directly influenced by the Fed’s monetary policy, and while the Fed has already cut rates three times since September 2024 (totaling a 1% reduction), long-term mortgage rates have **remained high, exceeding 7%. This has created a tricky situation for homebuyers—rates are coming down, but not as quickly as some had hoped.

What to Watch For:

- The first rate cut of 2025 is expected no earlier than June, with markets pricing in a potential drop to 3.9% by year-end.

- Long-term rates, including mortgage rates, are also influenced by market sentiment and external economic factors, meaning that even if the Fed cuts rates, home loan rates may not immediately decline.

Jerome Powell’s Outlook on Housing

Federal Reserve Chair Jerome Powell addressed the housing market during the FOMC press conference, highlighting key insights:

- Housing activity has stabilized after experiencing weakness in mid-2024.

- Mortgage rates remain high, and while the Fed's rate cuts should provide relief, external factors—such as supply constraints and demand fluctuations—continue to impact affordability.

- Powell emphasized that while inflation in housing services is cooling, the Fed still needs to see sustained progress before making additional rate cuts.

Will San Antonio's Housing Market Benefit?

San Antonio, like many cities, has felt the effects of high mortgage rates. With home prices in the city dropping 1.9% year over year, buyers may find more affordable opportunities in 2025. However, until mortgage rates decline further, affordability remains a challenge for many.

San Antonio’s real estate market has remained resilient, with steady demand and a median home price of $310,000 in 2024. However, as borrowing costs remain elevated, sellers may need to adjust pricing strategies to attract buyers who are more rate-sensitive.

Should You Buy Now or Wait?

For potential buyers, timing the market can be tough. While rate cuts could be on the horizon, housing prices may rise again as demand picks up in the latter half of 2025.

Key Considerations:

- If you find a home you love and can afford the monthly payments, locking in a fixed rate now could be a good move.

- If rates drop later in 2025, refinancing could be an option to lower monthly payments.

- For sellers, pricing competitively and offering buyer incentives—such as rate buydowns or closing cost assistance—can help attract interest in a higher-rate environment.

Final Thoughts

The Fed’s decision to hold rates steady highlights a cautious approach as it monitors inflation and economic growth. For buyers and sellers in San Antonio, the key takeaway is that affordability will remain a challenge in the short term, but opportunities exist for those who are strategic about their next move.

If you’re considering buying or selling a home in San Antonio, let’s talk! Contact Kristen Smith, Realtor, to navigate the market with expert guidance and personalized strategies to help you achieve your real estate goals.

Kristen Smith, Realtor San Antonio Best Realtor

Categories

Recent Posts

"Molly's job is to find and attract mastery-based agents to the office, protect the culture, and make sure everyone is happy! "