Should You Buy a Home During a Recession? Here’s What the Data Says

A shrinking economy. Rising mortgage rates. Flatlining prices.

If you’ve been thinking about buying a home in 2025, it’s no wonder you’re feeling hesitant.

The U.S. economy just posted a 0.3% decline in GDP for Q1 2025. It’s the kind of headline that makes people hit pause on big decisions.

But smart buyers aren’t freezing — they’re planning. Here’s how to be one of them.

💡 Step 1: Get Clear on What’s Actually Worrying You

Many buyers are saying the same thing:

“I think I just want to wait and see what happens with the economy. I don’t want to make a mistake.”

That’s understandable. Buying a home is a major life decision. But instead of sitting on the sidelines in fear, start by identifying what’s truly causing concern. Is it:

- High interest rates?

- Fear of a price drop?

- Job uncertainty?

- Market timing?

Once you know your "why," it’s easier to navigate your options with confidence.

📈 Step 2: Understand What the Market Is Actually Doing

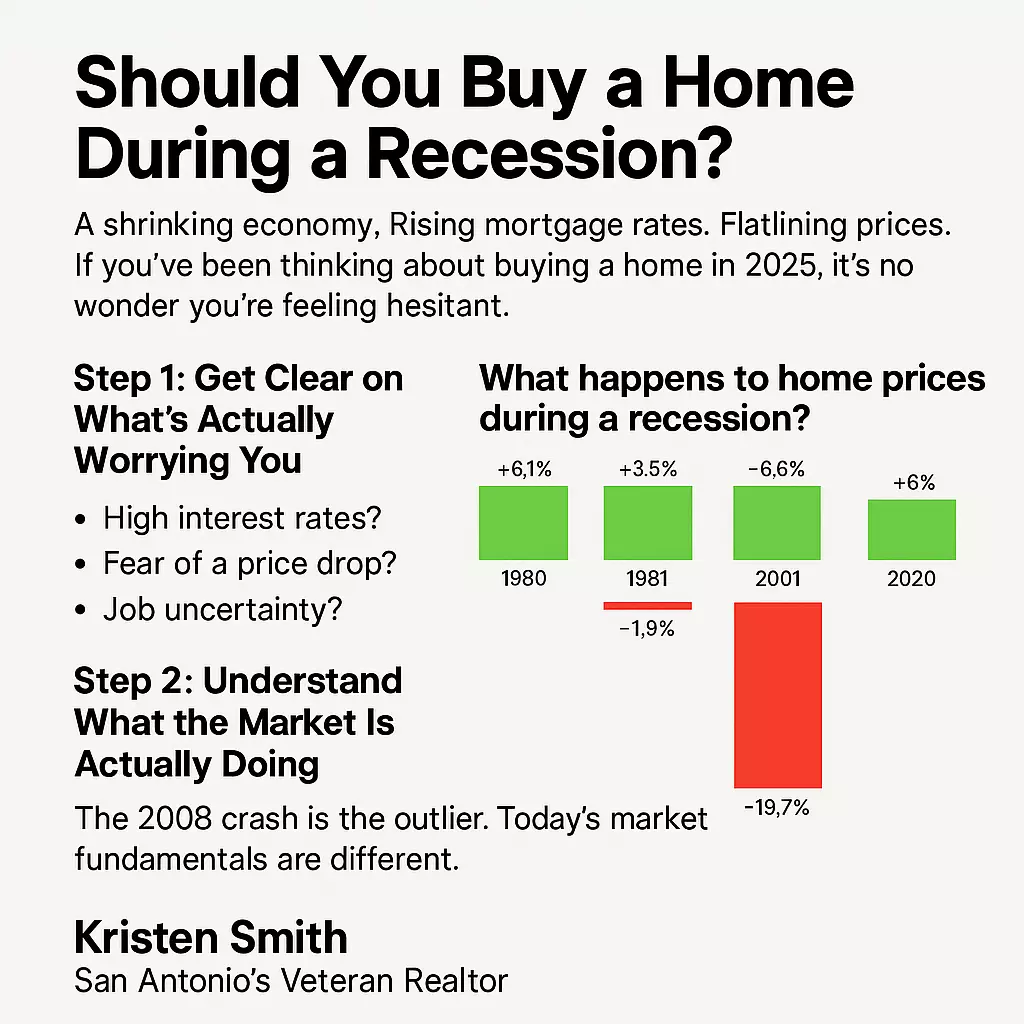

Here’s what most people don’t realize: home prices don’t always fall during recessions.

In fact, in four of the past six recessions, home prices actually went up:

📊

- 1980: +6.1%

- 1981: +3.5%

- 2001: +6.6%

- 2020: +6%

The 2008 housing crash was the outlier, not the norm. Today’s market fundamentals are very different.

🏘️ Let’s Talk About What’s Happening Now

According to the latest April 2025 Realtor.com report:

- 📈 Inventory is up 30.6% year-over-year — more choices, less competition

- 🏷️ 18% of listings had price reductions in April — highest for any April since 2016

- ⏳ Homes are taking longer to sell — median 50 days on market

- 💵 National median list price: $431,250, up just 1.1% per sq. ft. — values are stable

This is not a repeat of 2008. It’s a market correction — not a collapse.

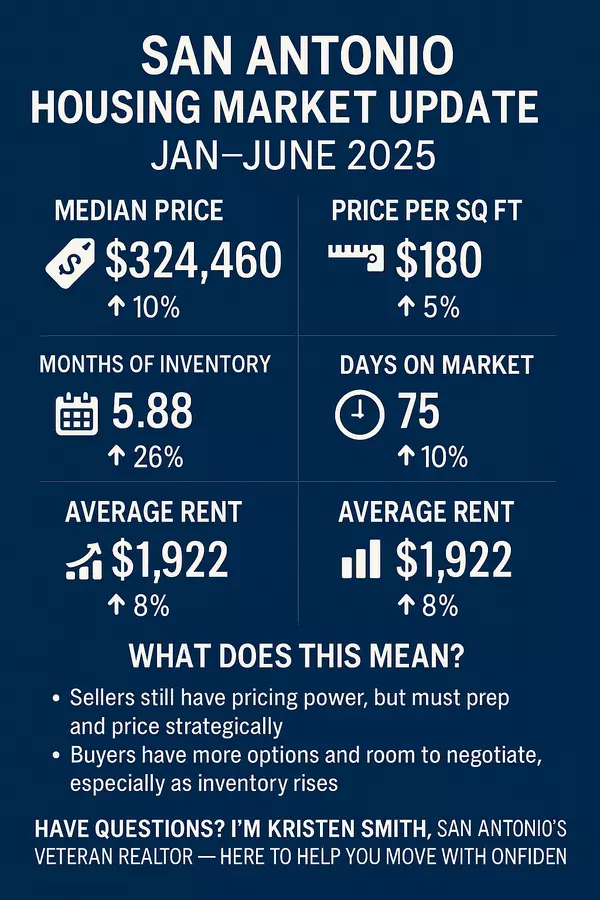

📍 Zooming in on San Antonio

Here in San Antonio, the market reflects these same patterns:

- 🏡 14,716 active listings — up 18% from last year

- ⏱️ Average days on market: 87

- 🎯 Buyers have more leverage, more time, and less bidding war stress

Real estate is always local — and this is your San Antonio snapshot.

🔑 Step 3: Build Your Game Plan

Whether you want to buy now or later, here are two smart paths forward:

✅ Option 1: Rent & Ready

Build a 6–12 month strategy:

- Save cash

- Improve your credit

- Track the market

- Get pre-approved

✅ Option 2: Move While Others Wait

Buy now while others hesitate:

- Take advantage of reduced competition

- Negotiate with motivated sellers

- Lock in a home before prices trend up again

Both are smart. It just depends on your goals.

💬 Final Thought: The Market Favors the Prepared

Yes, the economy feels uncertain. Yes, interest rates are higher than a few years ago.

But if history tells us anything, it’s this: real estate isn’t about timing the market — it’s about time IN the market.

Buyers who succeed in 2025 will be the ones who stayed calm, gathered facts, and made bold yet informed moves.

👉 Let’s talk about your 6–18 month plan. Whether you're ready now or just preparing, I’ll help you make the smartest move for your situation.

Categories

Recent Posts

"Molly's job is to find and attract mastery-based agents to the office, protect the culture, and make sure everyone is happy! "